The downside to American prosperity - 15 April 2024

Perhaps the best surprise of the past year and a half was the disinflation without increased unemployment (“immaculate disinflation”) seen in 2023. However, this trend seems to have stalled in the US in the first three months of 2024. It is too soon to say whether inflation will ramp back up significantly from current levels, but the risk of the US as a high-pressure economy is certainly increasing. Nevertheless, as we see it, the current growth hints at a soft landing rather than a recession. At this stage, the environment remains favourable to equities. The same cannot be said for long-term rates.

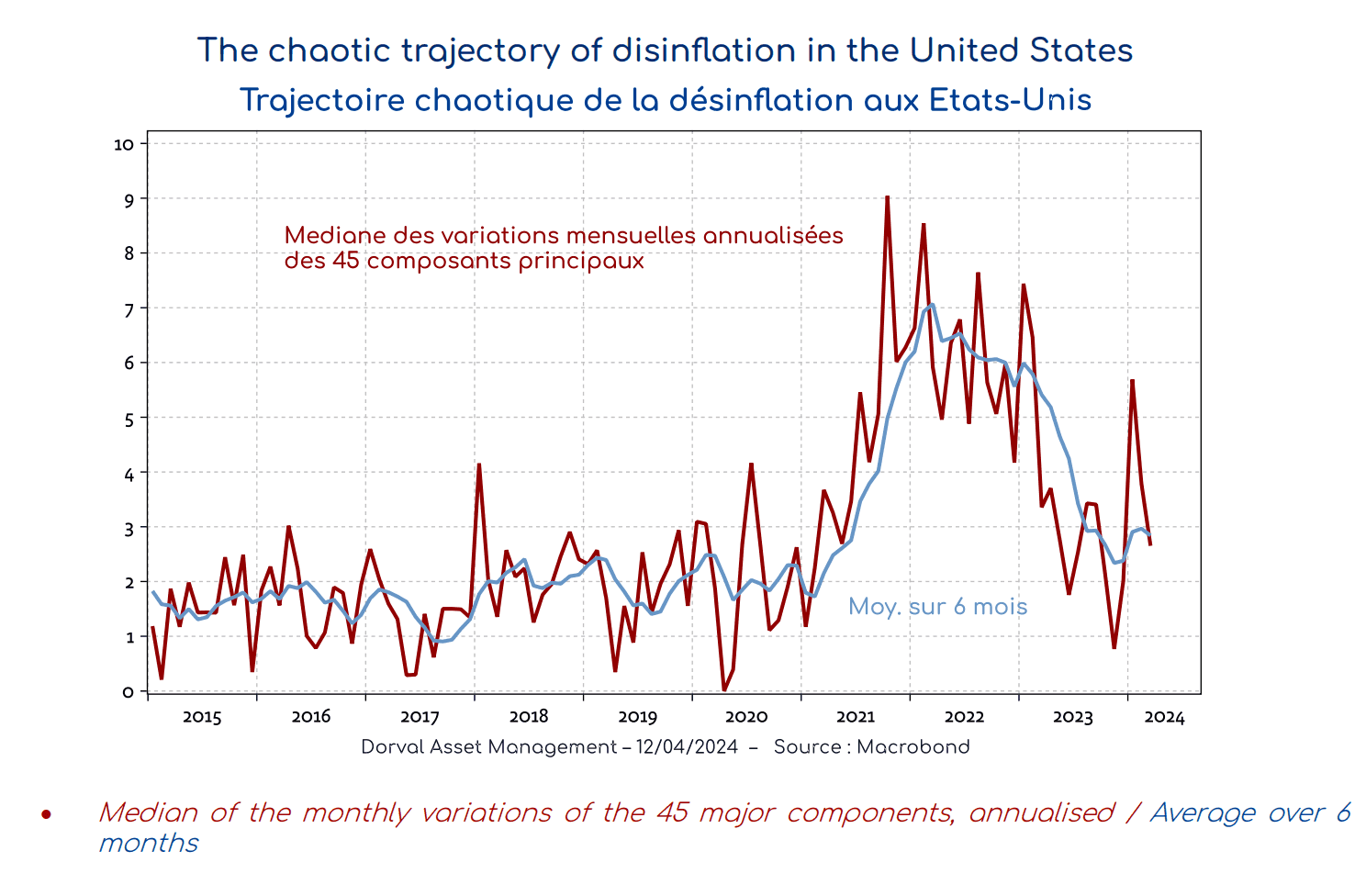

With the Consumer Price Index 0.1 pts higher than consensus expectations (+0.4% versus the expected +0.3%), March was the third consecutive month of bad surprises for inflation in the US. At present, it remains plausible that inflation makes a chaotic return to the target rate. As a reminder, the Federal Reserve uses the Personal Consumption Expenditures (PCE) deflator for its inflation targeting, not the Consumer Price Index (CPI). These two metrics differ in terms of both composition and methodology, and the PCE deflator tends to be less volatile and slightly lower than the CPI (the March PCE deflator will be published on 26 April ahead of the next Federal Open Market Committee meeting on 1 May). Looking at the monthly variation of the 45 major components of the CPI, and taking the median as the measure of central tendency, we can see that this has hovered around 3% following the spike in January (cf. chart 1).

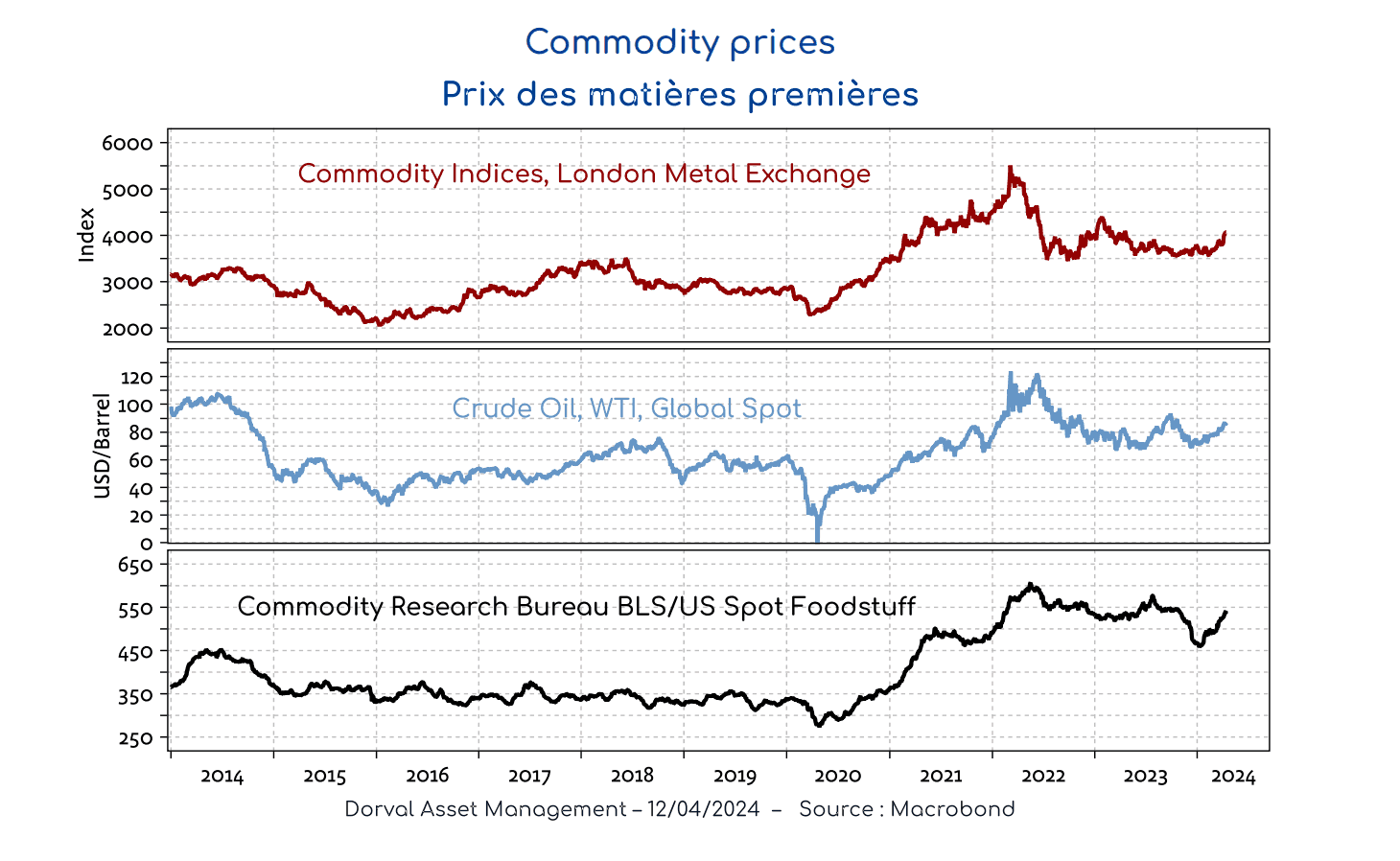

However, the current environment is less conducive to “immaculate disinflation” because: (1) the repercussions of the positive supply shock are now behind us (supply chains have normalised, net migration is positive once again, the labour market has rebalanced etc.); (2) improved growth prospects may encourage companies to raise their prices and employees to increase their demands (although there is no indication of this at present); and (3) the start of the industrial recovery brings with it pressure on commodities, particularly the price of oil against a backdrop of geopolitical tension (cf. chart 2).

These conditions will allow the Fed to keep waiting into the summer and beyond. Does this wait-and-see approach call into question our central bank put scenario ? We do not think so. Even with inflation stabilising above target, it remains close enough to target that the Fed could lower rates were the labour market to deteriorate. Moreover, the other central banks, and in particular the European Central Bank, are not in exactly the same situation as the Fed. Despite a widely anticipated status quo on its key interest rates, the ECB has suggested that if price data continues along its current trajectory, it would be appropriate to lower interest rates, likely as early as its meeting on 6 June.

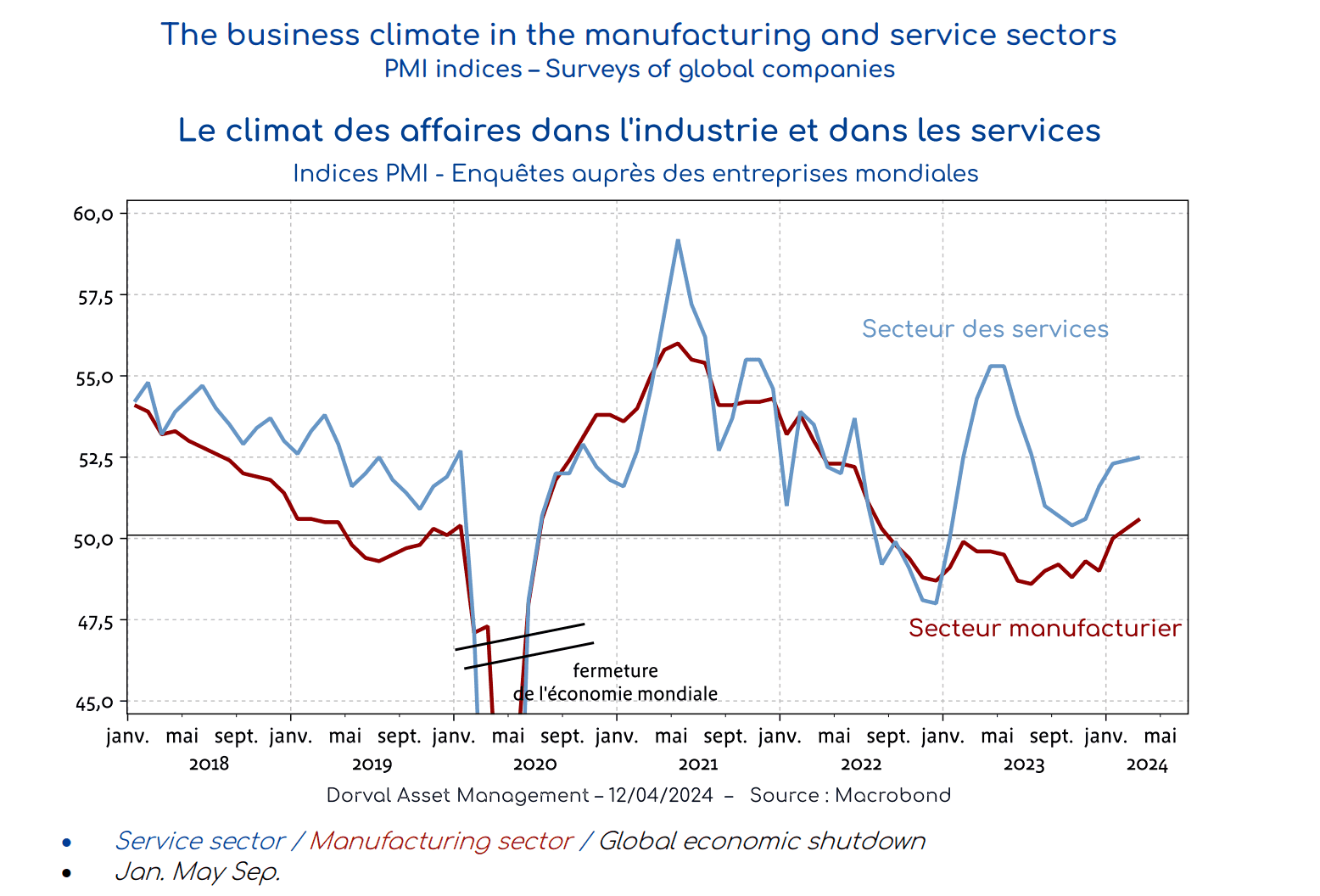

Although our core scenario of a good balance between growth prospects (cyclical conditions) and inflation risk (monetary conditions) has not changed, the risk scenario has become more likely in terms of inflation. However, in our view, the gradual improvement of the business climate revealed by the latest surveys means that, barring a geopolitical shock, the recession scenario has become less likely (cf. chart 3).

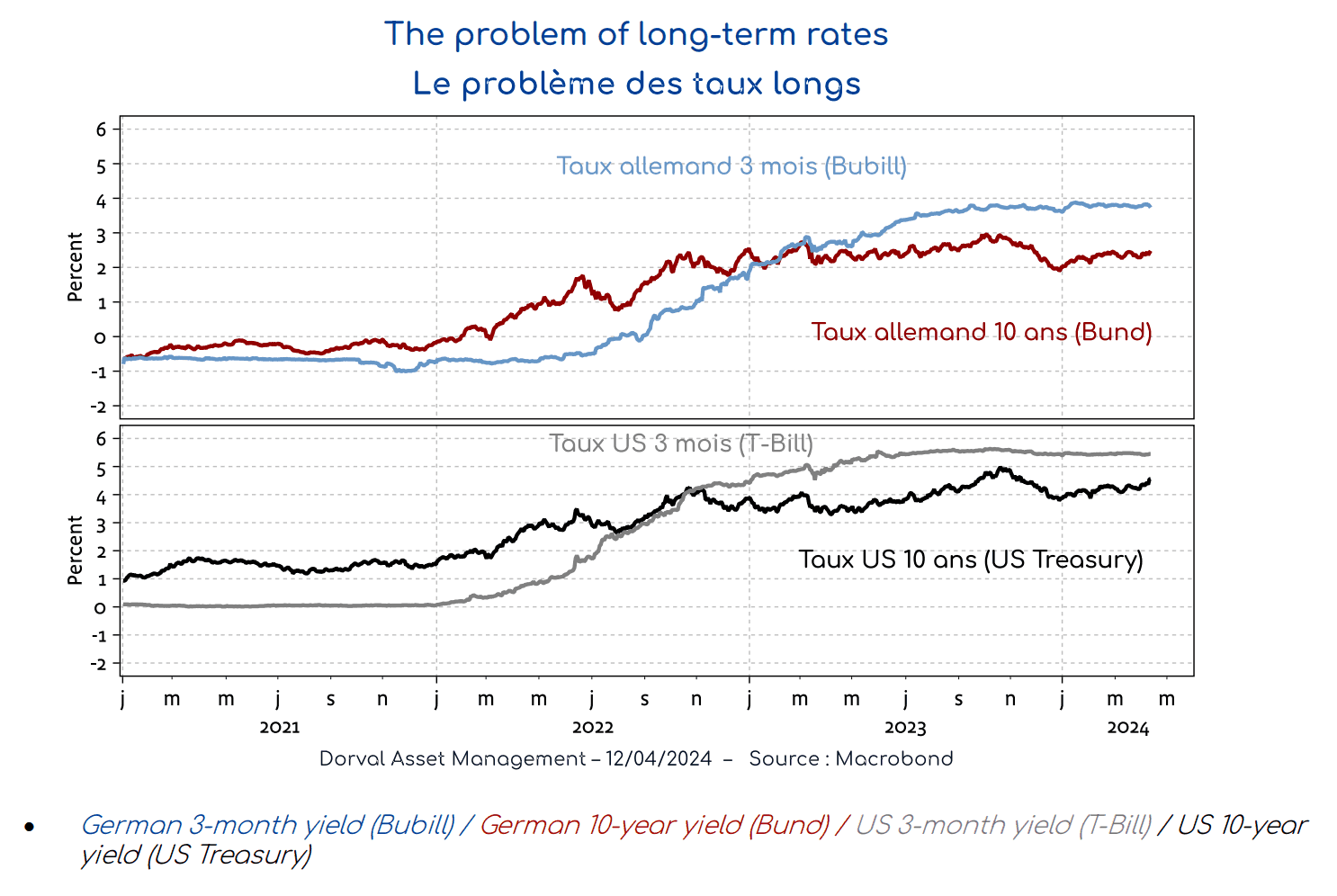

This new mix need not be particularly negative for the equity market. It is, however, bad news for long-term rates, which are still suffering from a negative term premium, i.e. when long-term rates are lower than short-term rates (cf. chart 4). The asymmetric hedging quality of sovereign bonds in a portfolio dominated by equities has therefore deteriorated.

The international equity markets are in a profit-taking phase after rallying in recent months. Although the greater likelihood of the inflationary risk scenario could justify increased risk aversion, this scenario seems to be particularly bad news for long-term rates, rather than equities. In this context, we are maintaining our key themes and moderate exposure to equities but, within our diversified international funds, we are selling our remaining positions in bond futures (German 2-year, French 10-year, US 5-year and US 10-year), which we had maintained for hedging.