The consequences of a more favourable European scenario - 8 April 2024

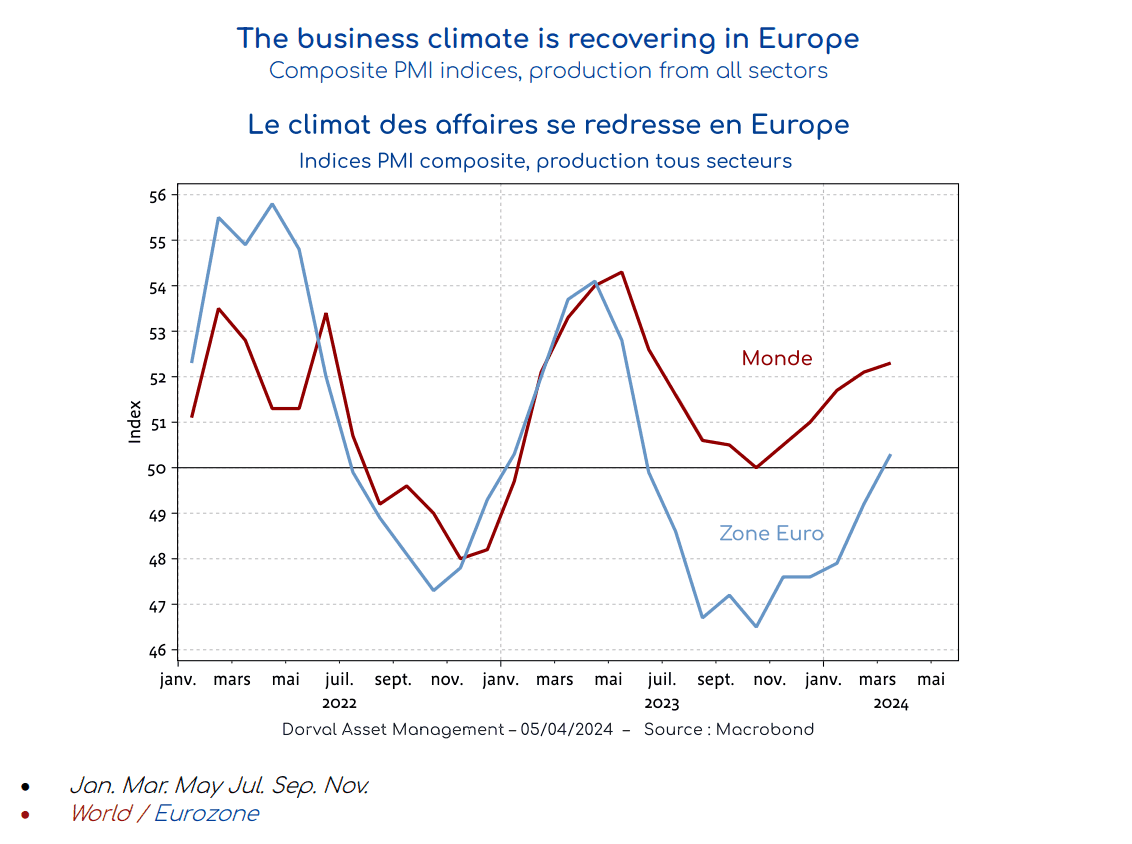

The scenario of a European economic recovery accompanied by an easing of the monetary environment is gradually taking shape. The small- and mid-cap segment could benefit from this. As tensions between Israel and Iran raise oil prices and result in profits being taken on financial markets, one of the problems facing the world economy – European stagnation – finally appears to be improving. According to surveys published by S&P Global, the eurozone composite PMI rose back above 50 in March and is continuing to catch up with the rest of the world (cf. chart 1).

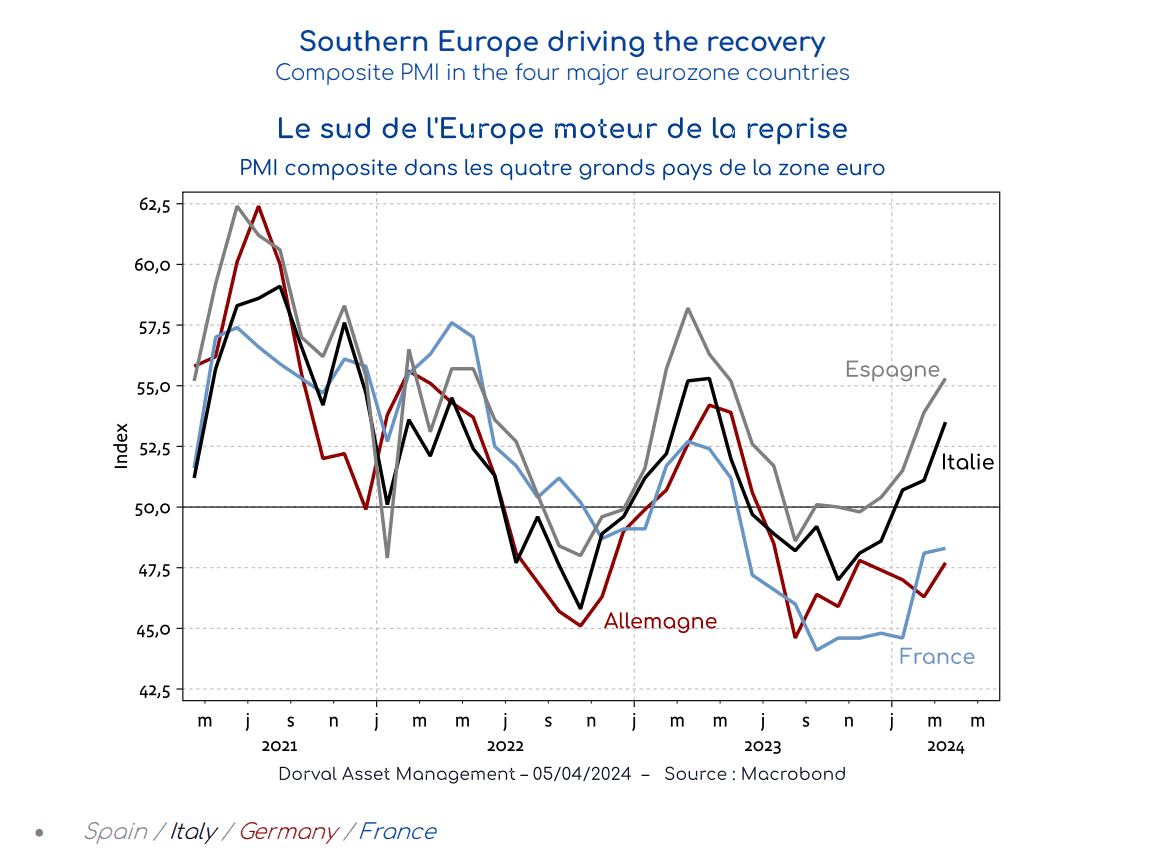

Improved purchasing power (confirmed by the good inflation figures for March), the end of the negative dynamics of industrial destocking, and the moderation of natural gas prices are among the factors supporting the recovery of the business climate. However, that climate remains very disparate. Partly helped by the European investment plan decided upon during the COVID-19 pandemic, Southern European countries are recovering significantly, while Germany and France still lag behind (cf. chart 2). The tightening of fiscal policy is one of the reasons why the economy is finding it more difficult to recover in France and Germany. This constraint should help the ECB to begin lowering interest rates, with a first cut already just about set for 6 June.

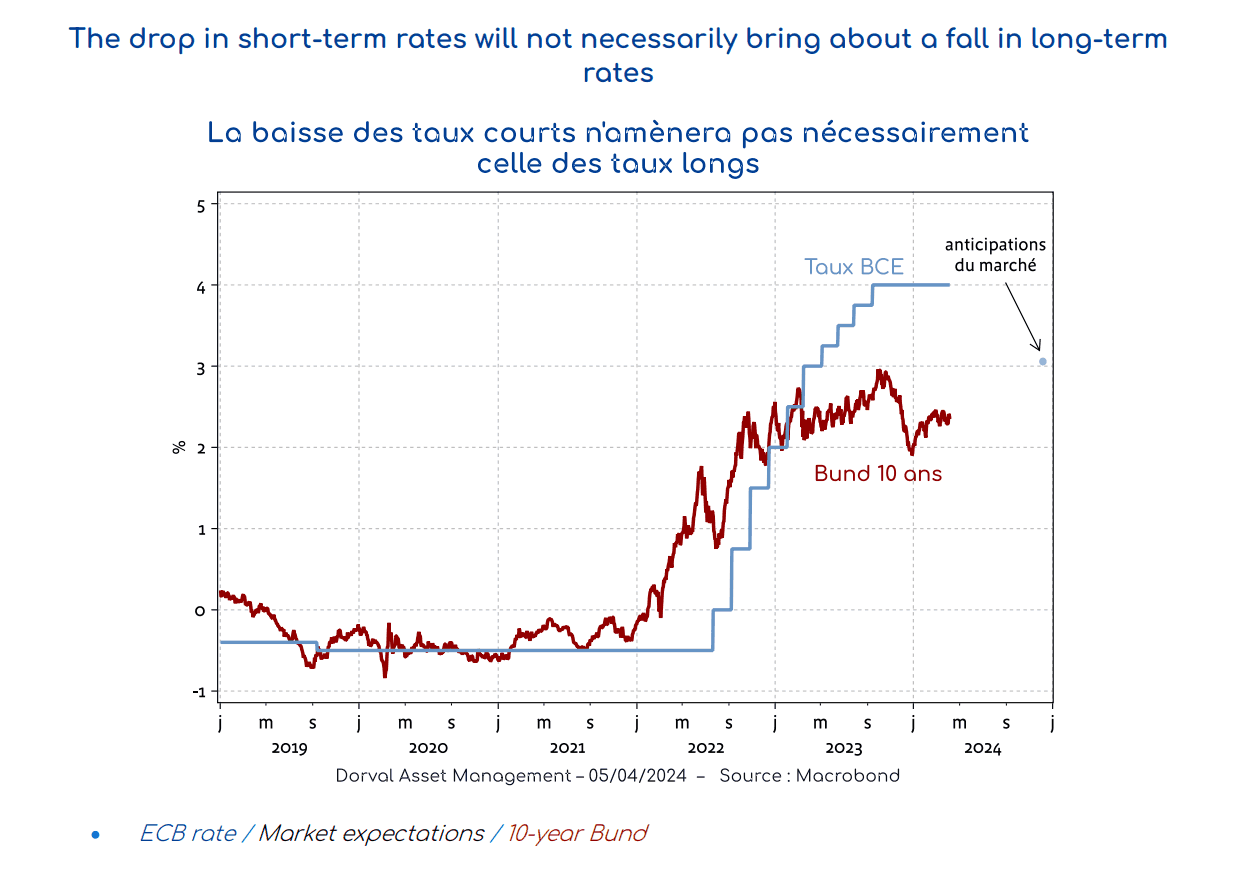

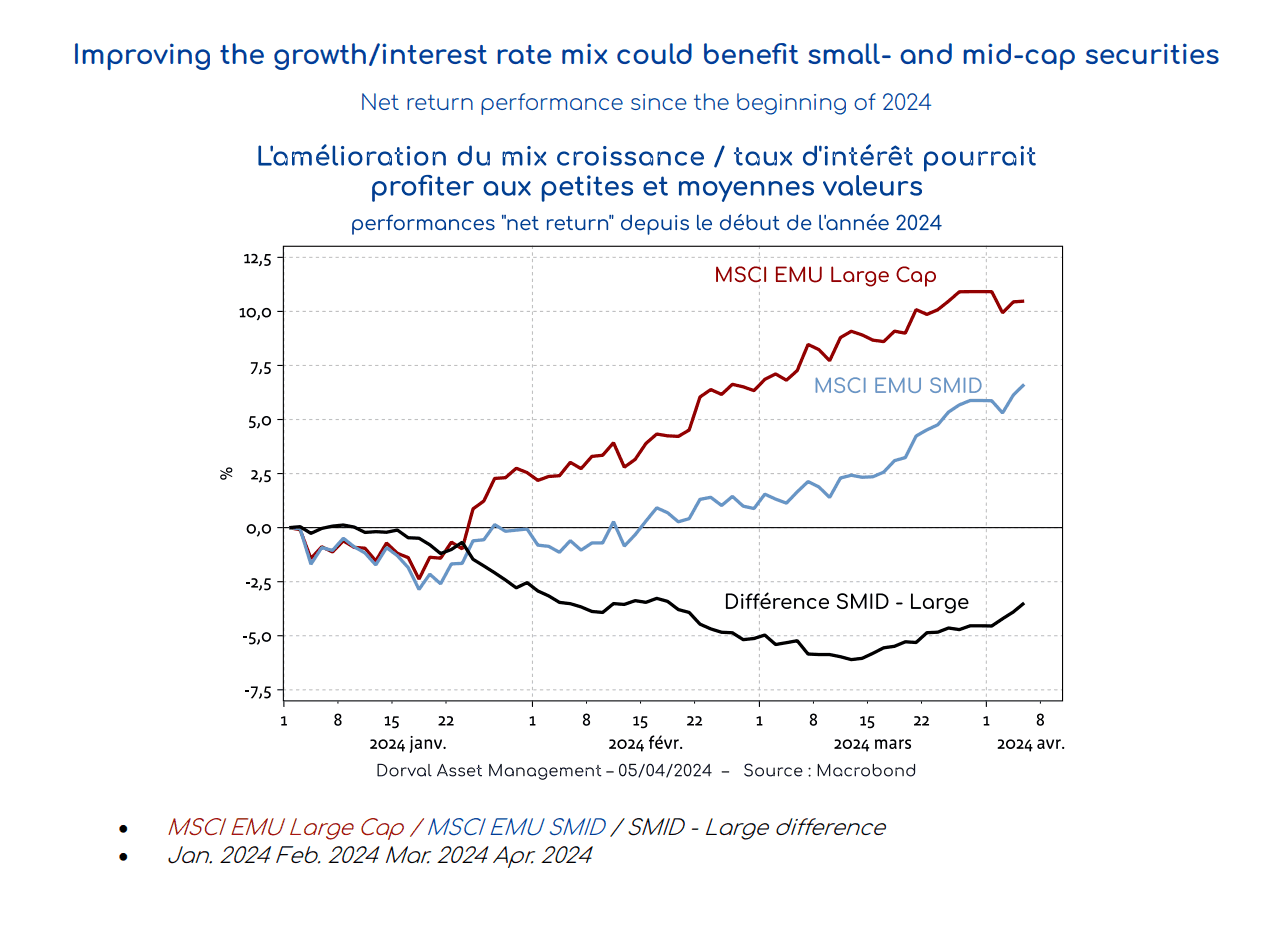

Investors are therefore presented with a doubly positive scenario of gradual European economic recovery combined with easing of the monetary environment. Investor enthusiasm, however, is dealing with two stark realities. First, eurozone equity market indices have already risen significantly, largely thanks to large multinational stocks that have been boosted by AI and the improvement in the overall stock market environment over the past six months. Secondly, the price of eurozone bonds already incorporates a scenario in which there will be substantial decreases in interest rates in 2024 and 2025, as evidenced by the very pronounced inversion of the rate curve (2.4% on German long-term rates, compared to 4% for money-market rates, cf. chart 3).

So what can we hope for in the markets under the positive European scenario that is unfurling ? In principle, this scenario could contribute to improving the relative performance of market segments perceived to be the most domestic. This is the case for small- and mid-cap securities in particular, the valuation of which is particularly attractive. Since mid-March, those securities have also begun to partly recover from their underperformance (cf. chart 4). In our European flexible funds, we have therefore decided to increase the weight of small caps from 8.5% to 11.5%. This exposure mainly takes the form of an equally weighted basket of 50 small caps to which we have applied liquidity, financial strength and profit growth filters, and which are set apart by their governance ratings. In return, we reduced our exposure to large caps by closing our “transition and productivity” basket.