Dorval Manageurs Europe

Choosing to support Europe's leading companies in a responsible and committed fashion

Key points

- Seeking to capture the growth of Europe's leading companies

- Active and unconstrained management, framed by a rigorous socially responsible investment policy

- A fund eligible for the PEA

- This product promotes environmental or social characteristics but does not have as its objective a sustainable investment. It might invest partially in assets that have a sustainable objective, for instance qualified as sustainable according to the EU classification

- The fund is exposed to the risk of capital loss

Evolution of performance

Past performances are no guarantee of future performances. The performance calculations are net earned dividends reinvested for the UCITS. The performance calculations for the benchmark indicator are reinvested net earned dividends.

Performance scenarios

| Recommended investment period: years Example of investment : Scenarios Select... | If you get out after 1 year | If you get out after years | |

|---|---|---|---|

| Minimum | There is no guaranteed minimum return. You could lose all or part of your investment. | ||

| Tensions | What you could get after deducting costs Average annual yields | ||

| Unfavorable | What you could get after deducting costs Average annual yields | ||

| Intermediate | What you could get after deducting costs Average annual yields | ||

| Favorable | What you could get after deducting costs Average annual yields | ||

The essential

- INVESTMENT UNIVERSEEuropean Union equities, all capitalisations.

- REFERENCE INDICATORMSCI PAN EURO (net total return)

- MINIMUM RECOMMENDED INVESTMENT HORIZON5 years

Performances

Performances net of management fees

Learn more

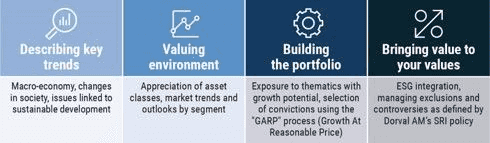

The fund seeks to support leading European companies and to capture their growth potential over the long term. To achieve this, fundamental analysis of eligible companies is combined with an approach to environmental, social and governance (ESG) opportunities and risks.

Responding to the financing needs of Europe's leading companies and capturing their growth potential

Among European stocks, Dorval Manageurs Europe invests both in large companies, to ensure liquidity and visibility, and in SMEs, for their performance enhancing effect. When selecting

securities, the management team pays particular attention to the valuation of companies, favouring stocks that combine growth prospects and a reasonable acquisition price. In addition, based on the observation that performance is achieved when the manager company couple is operating, an additional analysis is carried out, based on qualitative and quantitative criteria relating to the manager, the management team and the governance bodies.

Active and unconstrained management, framed by a rigorous socially responsible investment policy

The construction and management over time of the portfolio combines a financial and extra financial approach and is based on :

- An identification of investment themes considered as promising, i.e. in line with major trends and the economic and financial context.

- A selection of stocks within these investment themes supplemented by securities selected for their own interest and meeting the criteria defined by Dorval AM.

- The allocation of these securities in the portfolio is based on a proprietary rating methodology established using these same criteria and combining financial and extra financial analyses as well as an analysis of the " Manageurs /companies"

Information concerning the methodology and data relating to extra-financial analysis are available in the SRI policy and the Code of transparency of Dorval Asset Management available here.

A fund eligible for the PEA

In building up its portfolio, Dorval Manageurs Europe complies with the criteria of the French equity savings plan (PEA) by investing at least 75% in French and European equities.

One last question ?

- When we developed this fund in 2011, we drew on the principle that performances are driven by a successful manager-company tandem. We firmly believe that a company’s value depends first and foremost on this manager-company duo, and our analysis of companies is therefore partly based on managers’ contribution to their companies’ growth. This detailed and in-depth analysis draws on regular discussions with management at the companies Dorval AM invests in. In line with the management process for our Manageurs range – which contributed to our success – we have made corporate governance the cornerstone of our SRI policy. We believe that the sustainability of a company’s product and service range, the efficiency of its strategy and its execution all hinge on the quality of its governance, as does the firm's correct integration into its broader environment.

- We incorporate ESG criteria into our fund in a range of ways, both in determining the eligible investment universe and in our portfolio construction. Our non-financial analysis strives to deepen our insight into the companies in our portfolios, curtail certain specific risks and single out companies that enjoy ESG opportunities. Governance aspects truly take pride of place in our non-financial analysis, comprising at least 50% of each issuer’s ESG score. However, all three dimensions – E, S and G – are included in our non-financial analysis of companies in our investment universe.

Warnings

The information provided is neither contractual in nature nor serves as investment advice.

Past performance is no indicator of future performance. Capital invested is not guaranteed. It is advisable to follow the minimum recommended investment horizon. The characteristics, risks and charges concerning this investment are detailed in the fund prospectus, which is available free of charge from the asset management company.

The tax treatment depends on each client's situation and is subject to change at a later date. Each mutual fund may not be suitable for all investors. The risks of investing in a mutual fund are described in the Prospectus for this mutual fund, which can be downloaded from this site. Dorval Asset Management invites the individuals concerned to familiarise themselves with it.

Dorval Asset Management may not be held liable for any decision taken or not taken based on information contained in this document, or for how it may be used by a third party.

The investor must be given the Key Investor Information Document before subscribing.

Pursuant to provisions in Council Regulation (EU) No 833/2014, the purchase of units/shares in Dorval Asset Management’s funds is prohibited for all Russian and Belarusian nationals, as well as any individuals who are resident in Russia or Belarus and any legal person, entity or body established in Russia or Belarus, apart from nationals of a Member State and individuals holding a temporary or permanent residence permit in a Member State.