The recovery of European financials - 25 March 2024

After crippling European stock markets from 2007 to 2020, financial stocks are now contributing strongly to the return to favour of European equities. This theme is making less noise than that of AI, but it is powerful and remains undervalued.

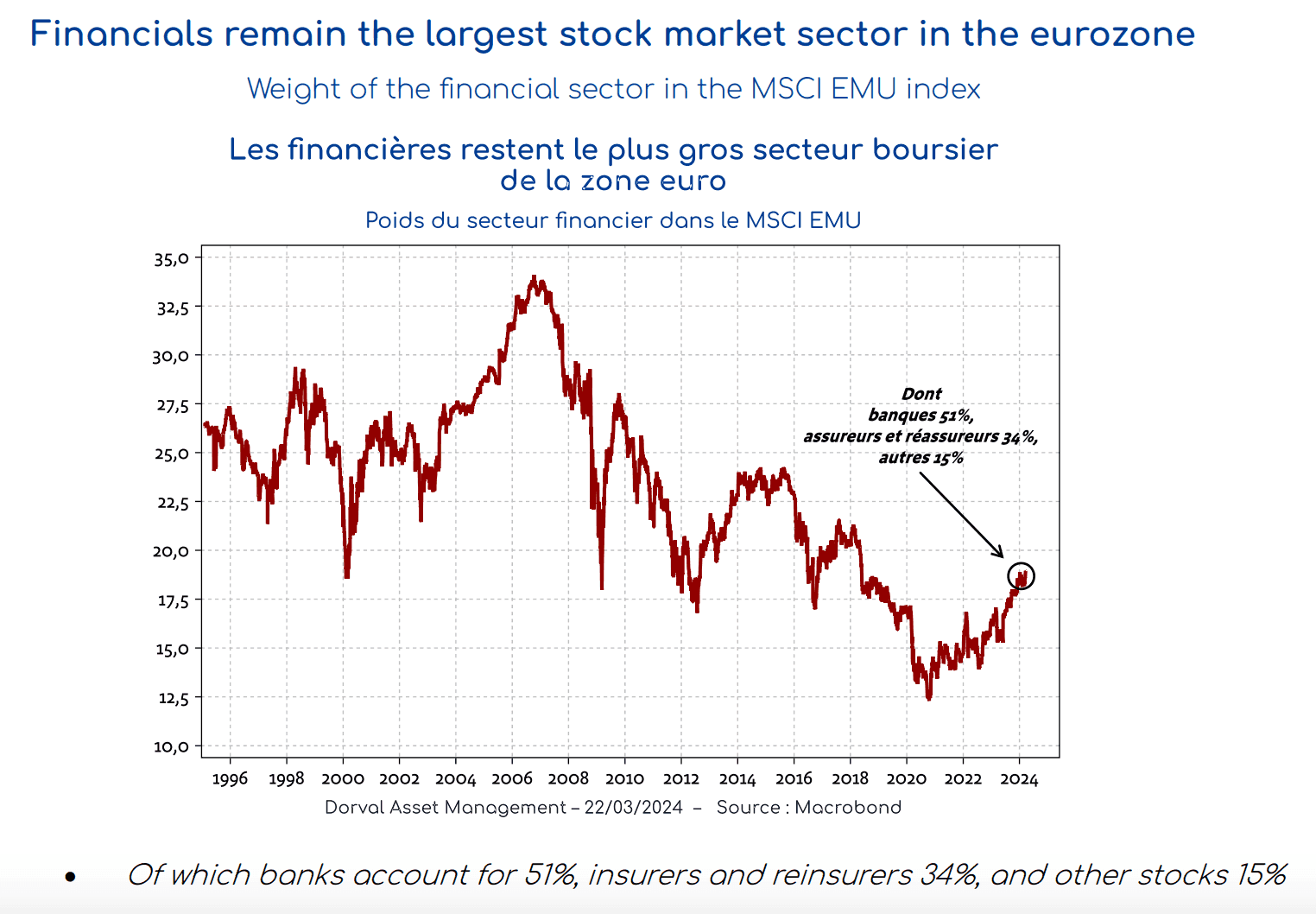

The financial sector accounts for nearly 20% of the MSCI EMU Index (cf. Chart 1). Although its weight is lower than it was prior to the 2008 financial crisis, it is the largest sector of the index, just ahead of industrial goods and services (17%), technology stocks (16%) and the consumer discretionary sector (15%). Half of the financial sector is dominated by banks, while a third is dominated by insurers and reinsurers, with financial services rounding out the market with 15%.

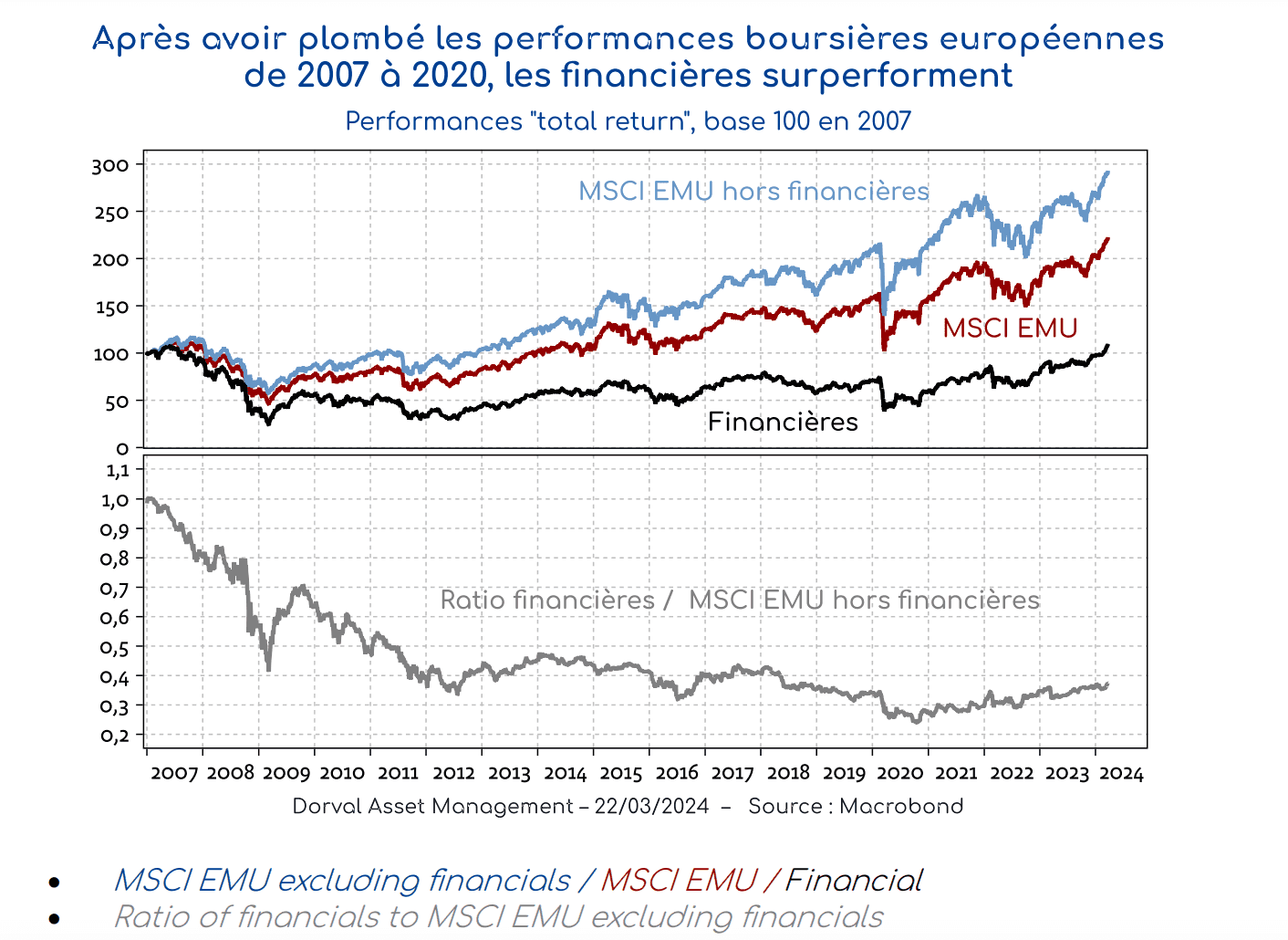

Having been forced to undertake massive increases in capital from 2008 to 2016, then undermined by negative ECB interest rates and negative real bond yields, eurozone financials reached their lowest point during COVID, in 2020. Throughout that period, they are thought to have wiped out around half the performance of the MSCI EMU index (cf. Chart 2). However, since 2020, the opposite has occurred: financial stocks are now overperforming and “boosting” the eurozone’s stock market indices. For the first time, the “total return” index for financials surpassed its 2007 level.

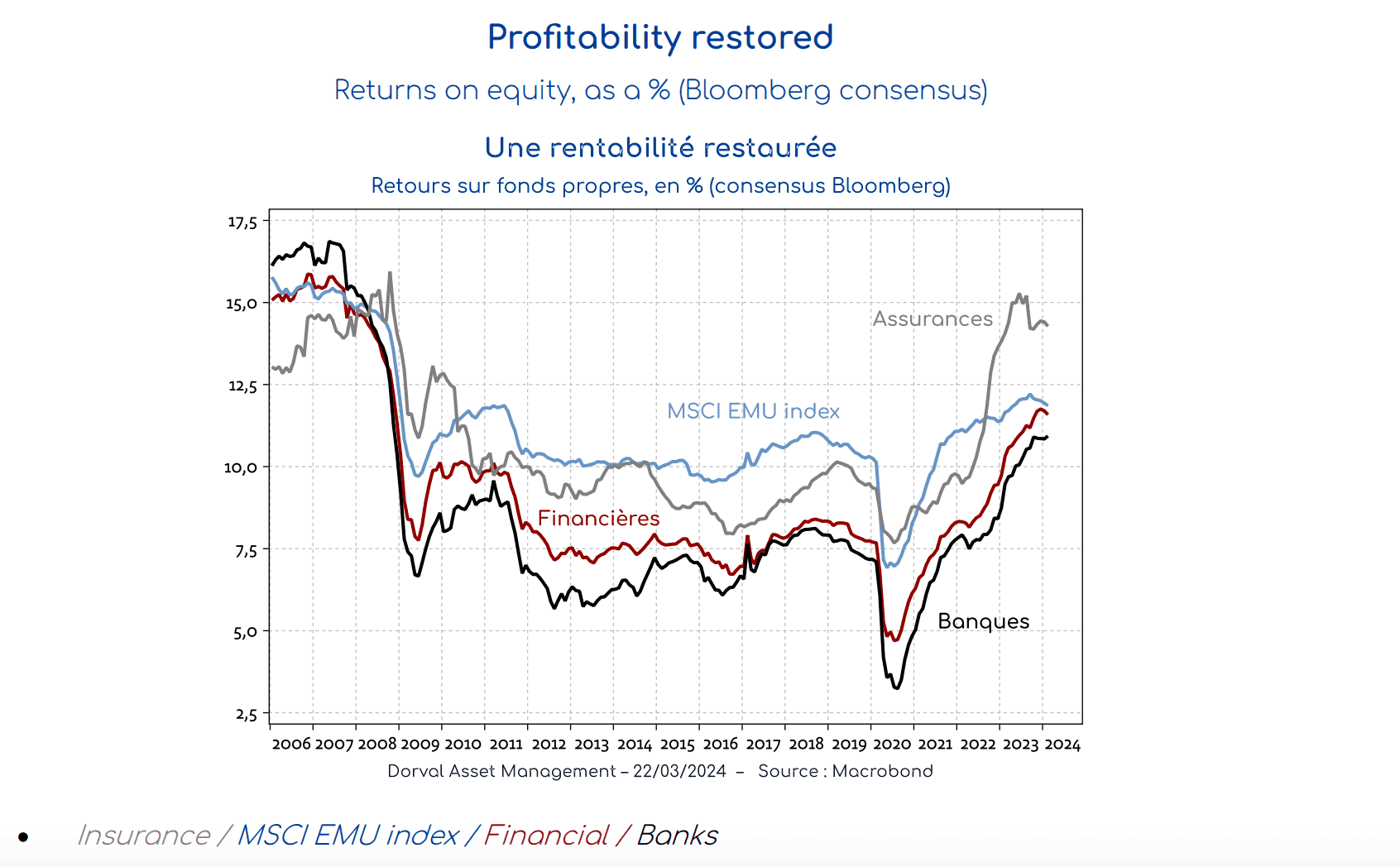

Improving bank profitability has been one of the most important drivers of this recovery. Restructured, consolidated and with better capitalisation, the banks have been able to take full advantage of the return of the ECB’s positive interest rates from 2022 onwards, with those rates now allowing the normalisation of net interest margins. Insurers have also taken full advantage of the normalisation of interest rates. Overall, the sector’s profitability in terms of return on equity has returned to the level it was at 15 years ago (cf. Chart 3), i.e. 12% on average.

If, as we believe will happen, growth prospects gradually improve in Europe in 2024/2025, the risk of a return to very low or even negative interest rates will recede, which could increase investor interest in financials. In addition, the financial sector, which is an extremely large consumer and producer of data, is often cited as one of the most promising sectors in terms of improvements to productivity enabled by artificial intelligence (administrative and legal services, risk analysis etc.).

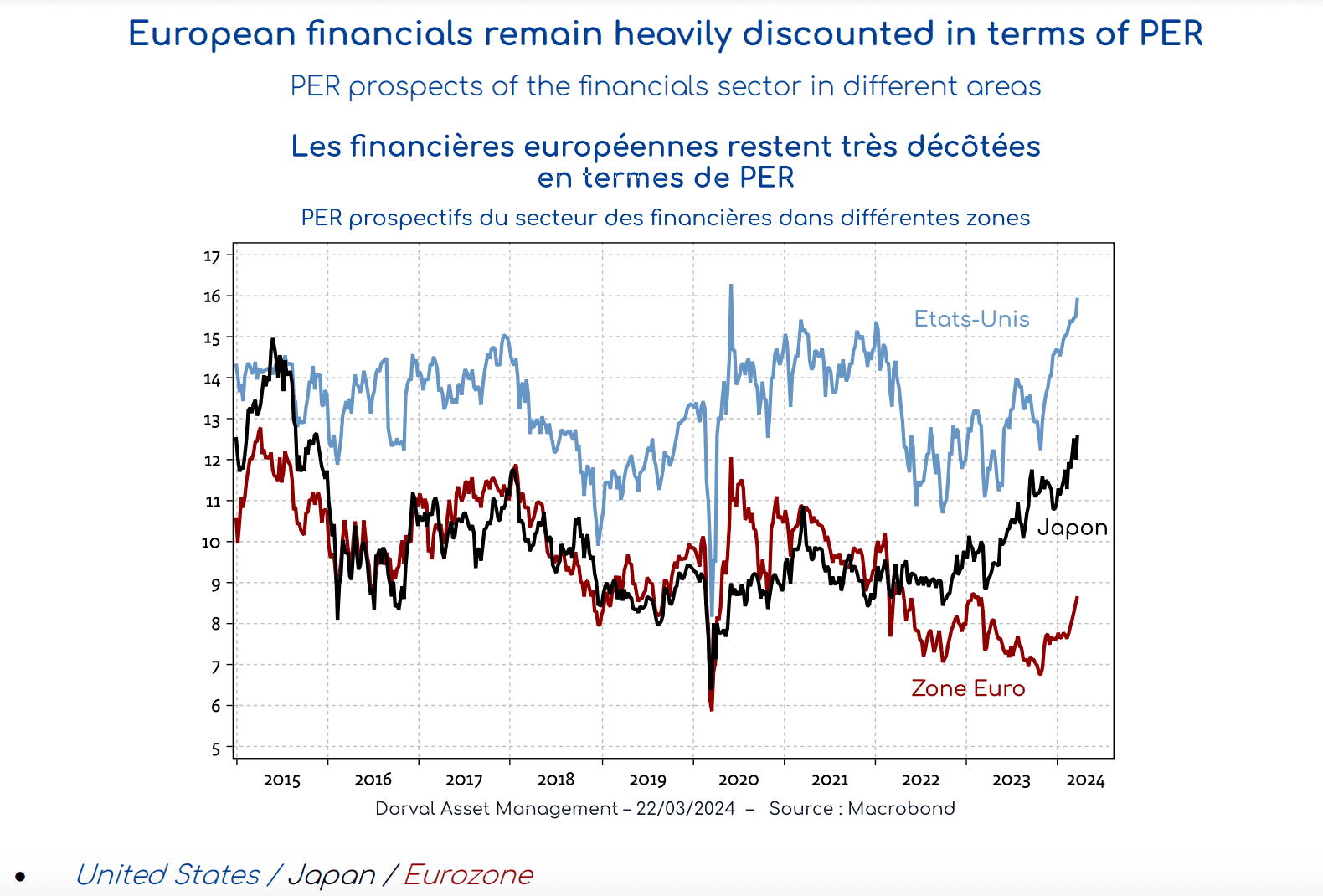

On the negative side, the sector remains, as always, very sensitive to political interventions, as we saw in 2023 with the threats of taxes on the profits of Italian banks and shocks of all kinds (with Credit Suisse and the US regional banks in 2023). It is therefore necessary to always check that the valuation of financial stocks offers a sufficient risk premium. From this point of view, European financials tick all the boxes. They offer a dividend yield of 6%, which is twice as much as for the rest of the market, and their PER (price-to-earnings ratio) has remained extremely low, in contrast with what has happened in Japan and the United States (cf. Chart 4).

At a time when increasing numbers of investors are in search of themes to diversify their holdings, we feel that the theme of European financials is particularly relevant. Profits in that sector are rising faster than those of the market in general, the valuation is very attractive, and the correlation with the other buoyant theme of the moment – that of artificial intelligence – has been close to zero over the last two years. While it was already highly present in our European funds, we are now incorporating this theme into our global funds.