European policy mix good news for financial markets - 22 April 2024

An economic recovery in Europe seems increasingly likely. But it is particularly the prospect of a recovery orchestrated by monetary policy rather than fiscal policy that appeals to the financial markets.

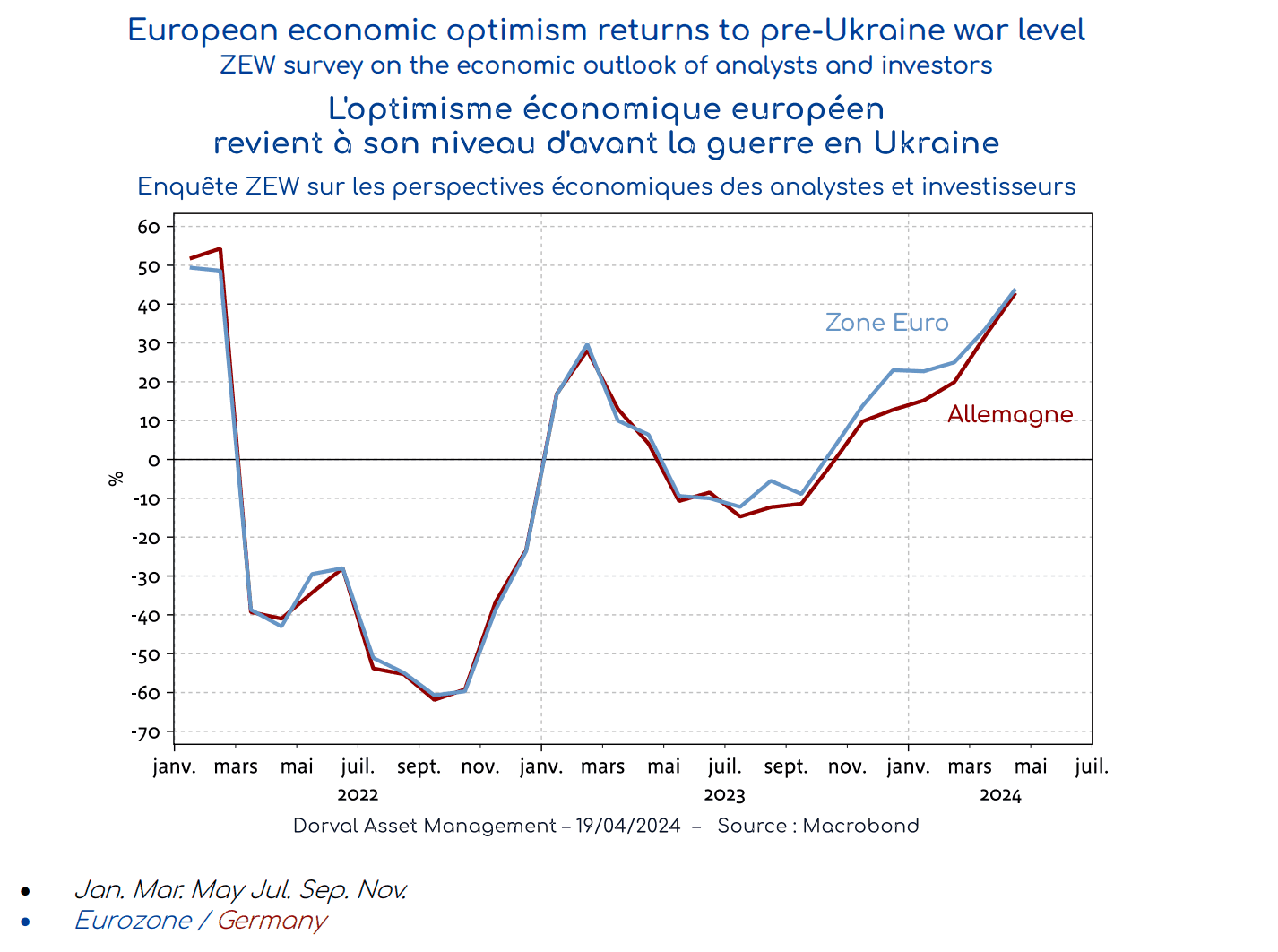

After an historic slump in 2022 following the war in Ukraine and the ensuing energy crisis, it seems like a new chapter has begun with economic optimism back in Europe, at least from the perspective of German financial investors and analysts (cf. chart 1). For both Germany and the eurozone as a whole, the ZEW survey reveals a very optimistic economic outlook for the next six months.

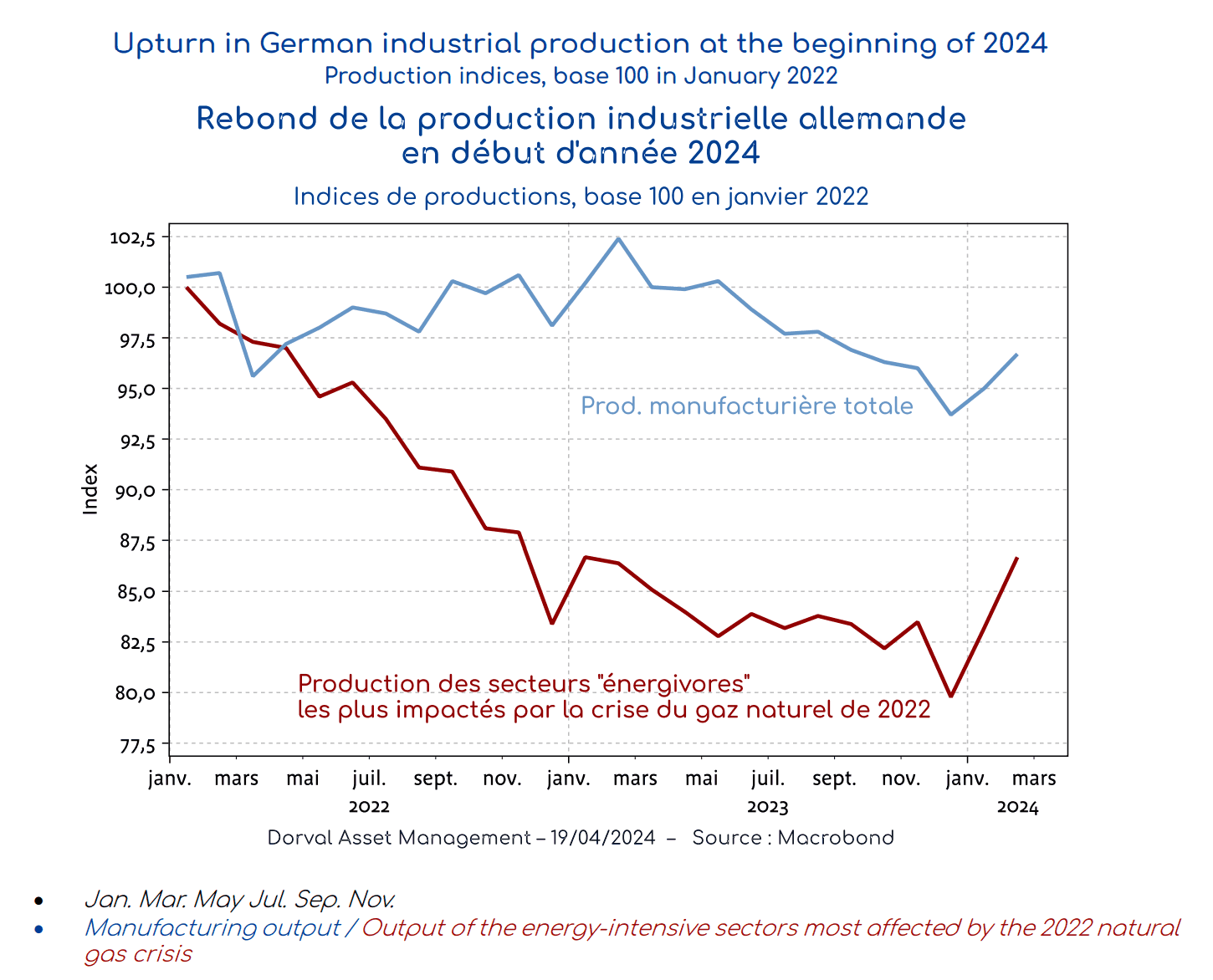

This optimism is obviously relative. It is easier to envisage an improvement when the situation is bad than when it is already very good. For the time being, the eurozone economy is still fairly stagnant, but green shoots have recently appeared. As an example, German industrial production experienced an upturn in both January and February 2024, particularly in those sectors that had been most affected by the shut-off of Russian gas (cf. chart 2). These figures prompted the German government to revise its 2024 GDP forecast up slightly, from 0.2% growth to 0.3%. Growth remains weak, but the momentum has shifted.

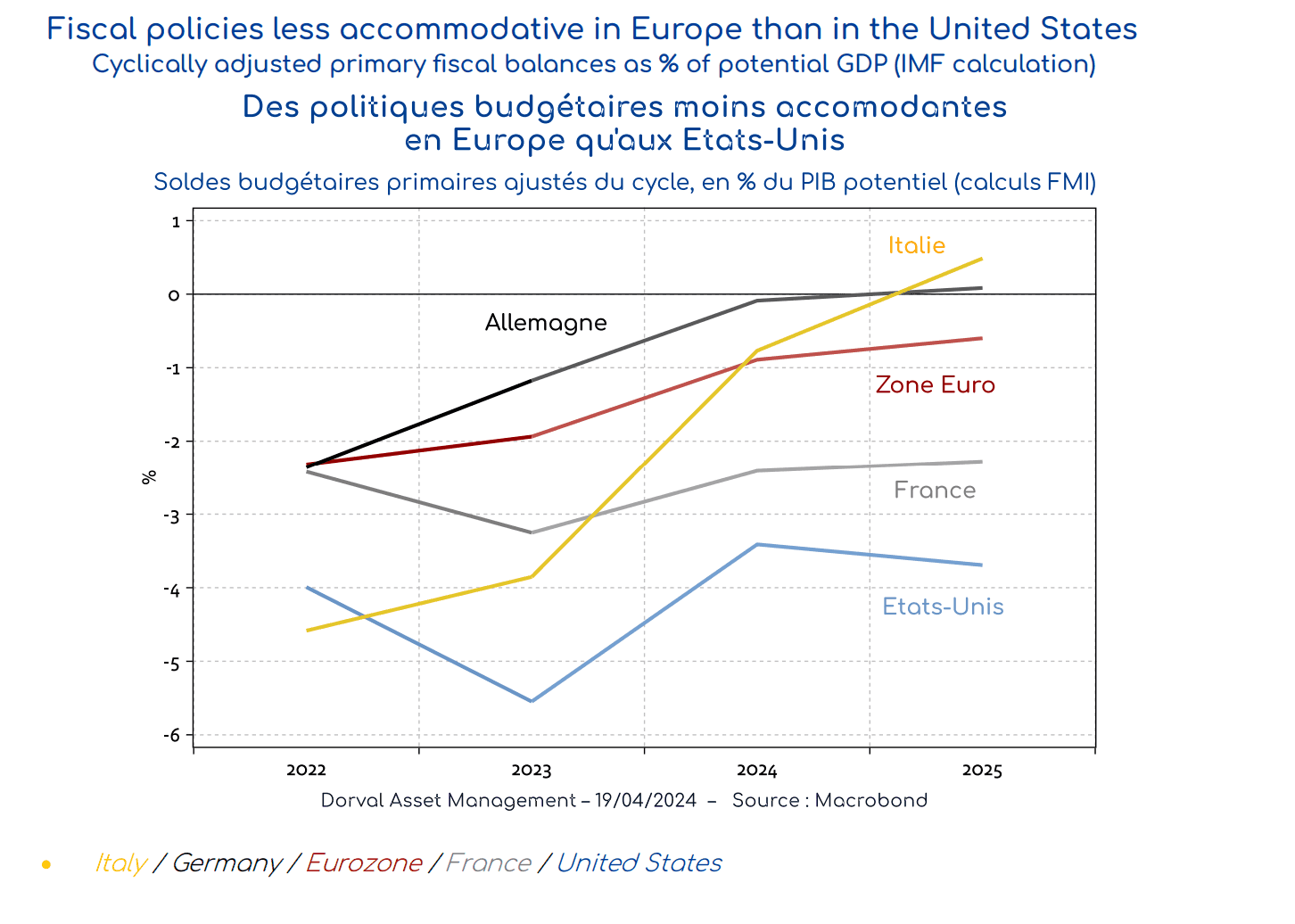

A stronger and more solid recovery will require an upturn in consumption. The disinflation confirmed by March data should help with this, but the effects on eurozone consumption remain scarcely visible for the most part. One of the reasons is probably that, in stark contrast to the US, eurozone fiscal policy is not very accommodative. The IMF has estimated that the eurozone’s structural budget deficit will be 1% of potential GDP this year, three times less than in the US (cf. chart 3). Germany has imposed an austerity package in the wake of rulings by its Federal Constitutional Court, and Italy needs put a stop to the excesses brought about by its so-called “superbonus” measure introduced during COVID. This somewhat extravagant measure entitles Italians to a tax credit from 90-110% of home renovation costs and had contributed to the sharp recovery of the Italian domestic economy in 2022 and 2023, but this is now experiencing a gradual downturn.

As we have seen in France with the finance minister’s calls for prudence, Europe is providing less fiscal support to its economy than the United States. While this is a disadvantage, it is being offset by lower interest rates. While the Federal Reserve has recently rejected the idea of a future rate cut, it will be a big surprise if the ECB does not initiate a round of cuts as early as 6 June 2024. This means that monetary conditions will begin to ease in the eurozone, with a competitive exchange rate, the interest rate curve beginning to straighten and banks offering gentler lending terms.

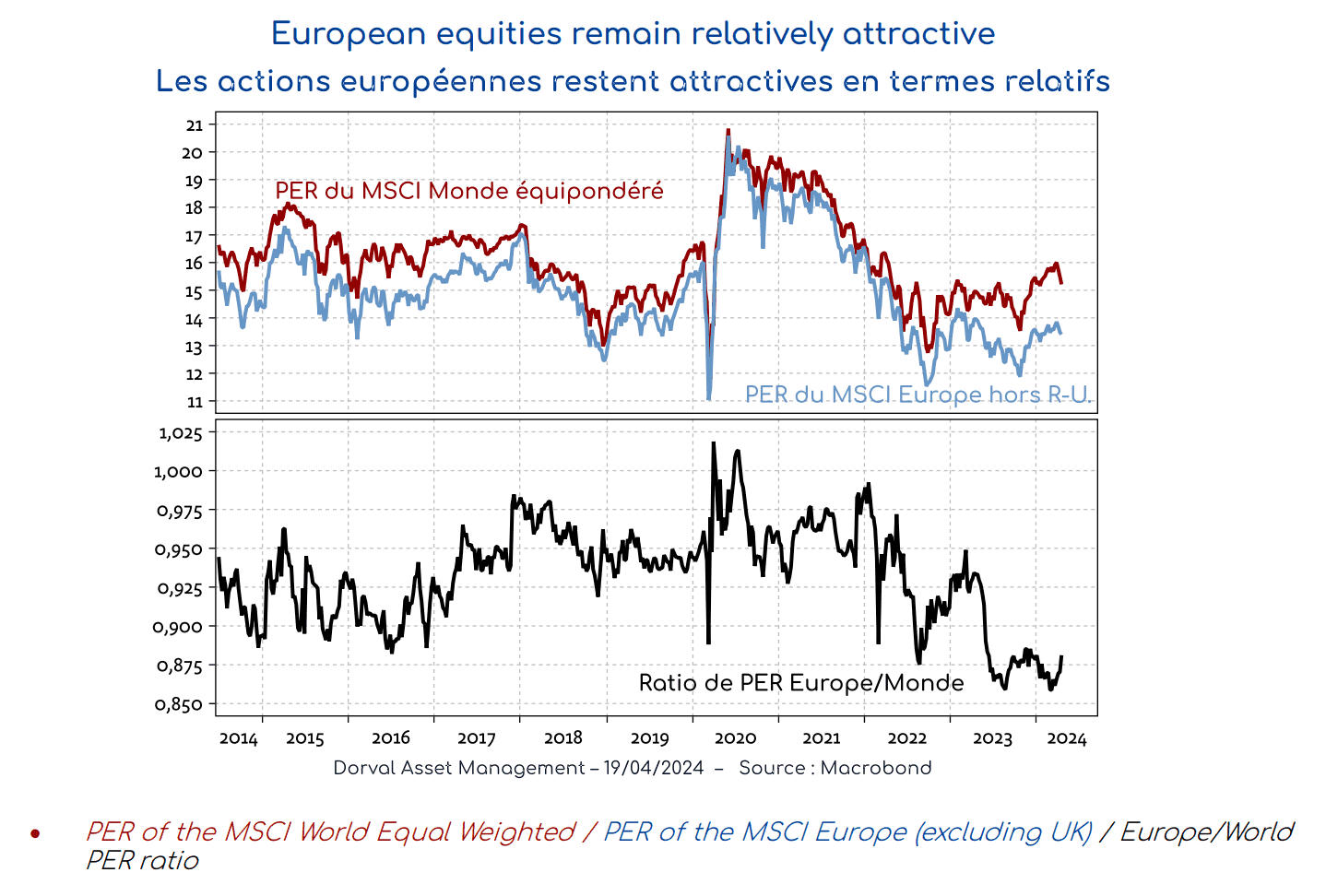

This policy mix, i.e. the way fiscal and monetary policies complement each other, is relatively favourable to the European financial markets. While fiscal support is often more effective in generating a strong economic recovery, monetary support has a more widespread effect via the financial markets. This favourable scenario is already in evidence in both prices and investor behaviour, as shown by European equities and bonds outperforming their American counterparts in recent weeks. Having said that, European equities remain cheap, with a PER of 13.5x for the MSCI Europe Equal Weighted Index (excluding the UK), compared to more than 15x for all developed markets (cf. chart 4). The ratio between the two PERs remains close to recent historical lows.

Overall, the scenario of the European financial markets outperforming the rest of the world is becoming more likely thanks to both catch-up growth potential and a favourable policy mix. This optimism, which rarely seen in Europe, carries with it an inevitable risk of disappointment if the expected trajectory of growth, inflation and/or interest rates does not materialise. We also know that European stock exchanges are sensitive to US financial conditions, which have recently deteriorated. These risks must be monitored. However, with European equities still enjoying low valuations – especially small and medium-sized stocks – their relative performance potential remains considerable for the rest of the year.