Equal weighting: an effective weapon against the sudden rise of specific risks - 11 March 2024

Propelled by the theme of AI, stock market indices are surging towards what could in part be a bubble; but a particular type of bubble, given that it entails risks that are specific to a few companies. Equal weighting of portfolios and themes is an appropriate response to this new challenge, making it possible to invest in bull markets while limiting these risks.

Observers, even those who are fairly removed from financial markets, are starting to see that something is in the wind. The CAC 40 has just exceeded 8000 points, global indices are at all-time highs, and talk of a “bubble” has made a reappearance. Identifying the existence of a stock market bubble with confidence and in real time is a perilous exercise. A bubble is characterised by a lasting surge in the valuation of a specific part of the market which, driven by an optimistic narrative that becomes increasingly widespread, sees its weight become predominant in the indices.

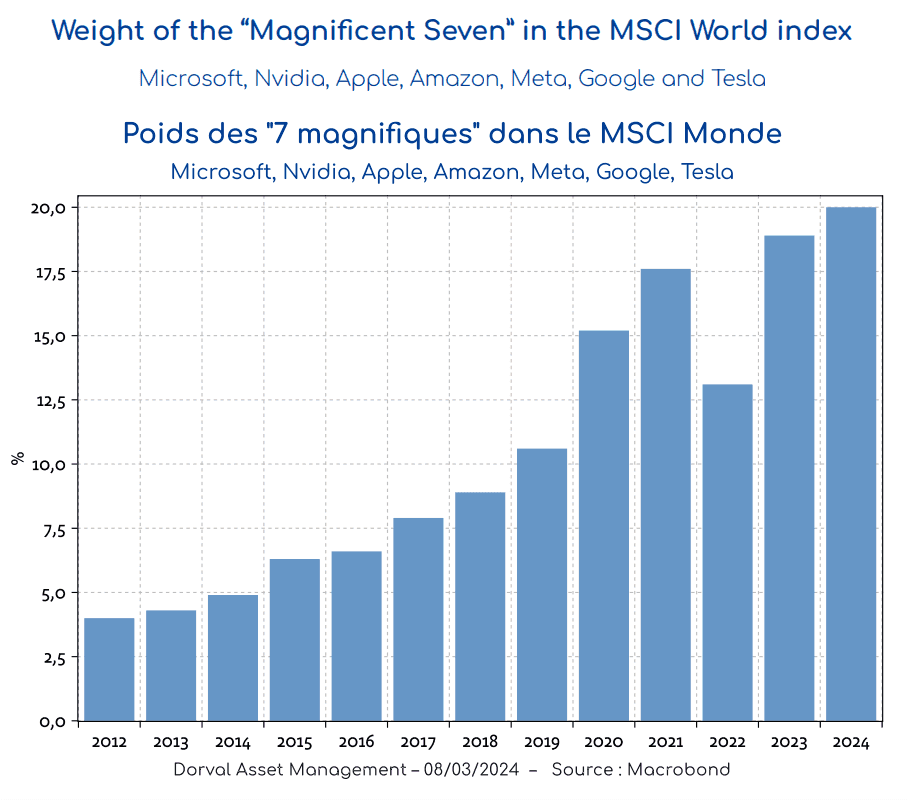

Since the 1960s, there are generally considered to have been three large bubbles that concentrated global market capitalisation for a time. First among them was the case of the “Nifty Fifty” stocks (1965–1972), during which around fifty very large American companies dominated the world in multiple sectors of activity (IBM, McDonalds, Coca-Cola, Xerox etc.), which made them “essential” in the eyes of savers – regardless of their price. Next came the Japanese bubble, with Japan’s apparent dominance over the economic and financial world resulting in a gigantic shift in global capitalisation in favour of Japanese equities, which accounted for more than 40% of the MSCI World index in the late 1980s. Finally, there was the Dot-Com bubble of 1995–2000, driven not only by telecoms and information technology equities but also by all the major growth securities. Today, the question of whether there is (or isn’t) a bubble hinges on the link between a trendy theme – the theme of AI – and the already blatant dominance of a small number of US “new economy” giants over global market capitalisation (the “Magnificent Seven”, cf. chart 1).

In our view, it is perhaps still a little early to protect against a major correction of a possible bubble driven by the theme of AI, a theme that is ultimately a relative newcomer to the stock market. At the same time, it is not too early to take precautions against this record market concentration around just a few stocks. Indeed, it is this concentration that has ushered in the new issue of company-specific risk – a type of risk that has traditionally been highly diluted in major global stock indices, even during bubbles. This issue of specific risk is beginning to take shape due to the fact that three of the Magnificent Seven – Tesla, Apple, and Google – have been falling in value on rising markets since the beginning of the year. For the time being, these drops in value have been more than offset by stellar performances from Nvidia and Meta, but there is no guarantee that this will continue.

It may therefore be beneficial to follow a portfolio strategy aimed at limiting the specific risks that are now building on the major indices. In this regard, the most effective method – the one that minimises these risks – is the equal weighting of stocks. This equal weighting method can be applied to an index, a portfolio or to themes, and is the approach that Dorval AM has implemented in its international funds since 2016.

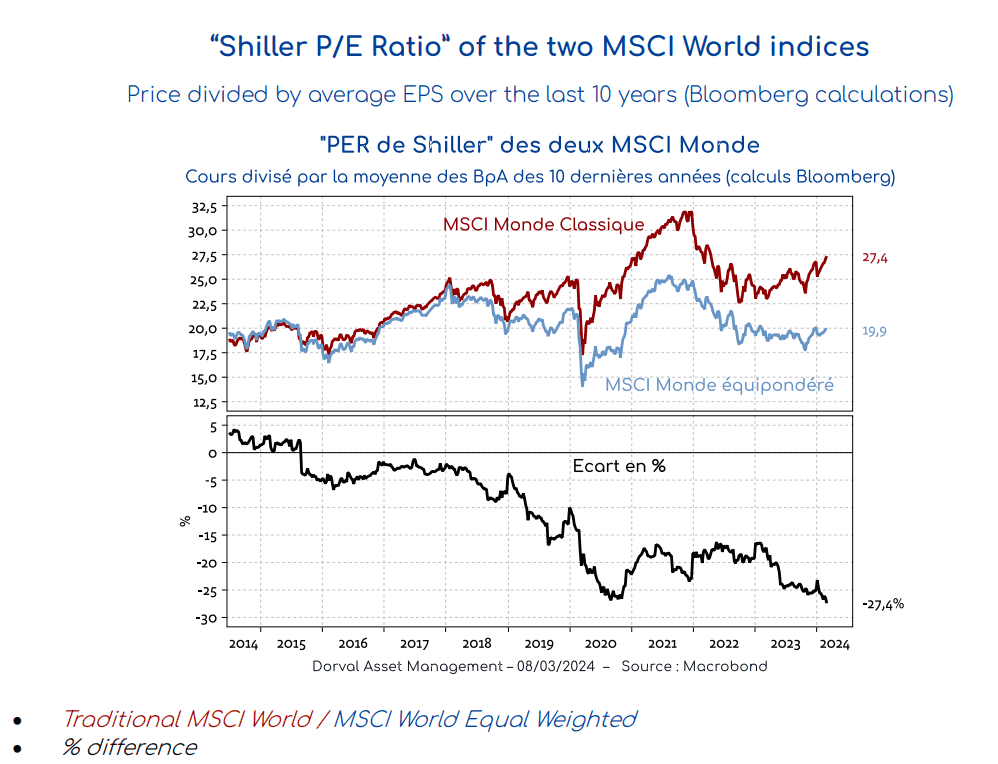

In addition to minimising specific risks, an equal weighted portfolio of global equities from developed countries has the advantage of offering a valuation that is now significantly more attractive than that of the cap-weighted MSCI World index, which is dominated by the Magnificent Seven. With a “Shiller P/E Ratio” (ratio between prices and average earnings over the last 10 years) of 20x, the MSCI World Equal Weighted index compares favourably to the 27x of the traditional MSCI World index (cf. chart 2) and remains within its historical average. Suspicions of a bubble do not negatively impact this kind of portfolio.

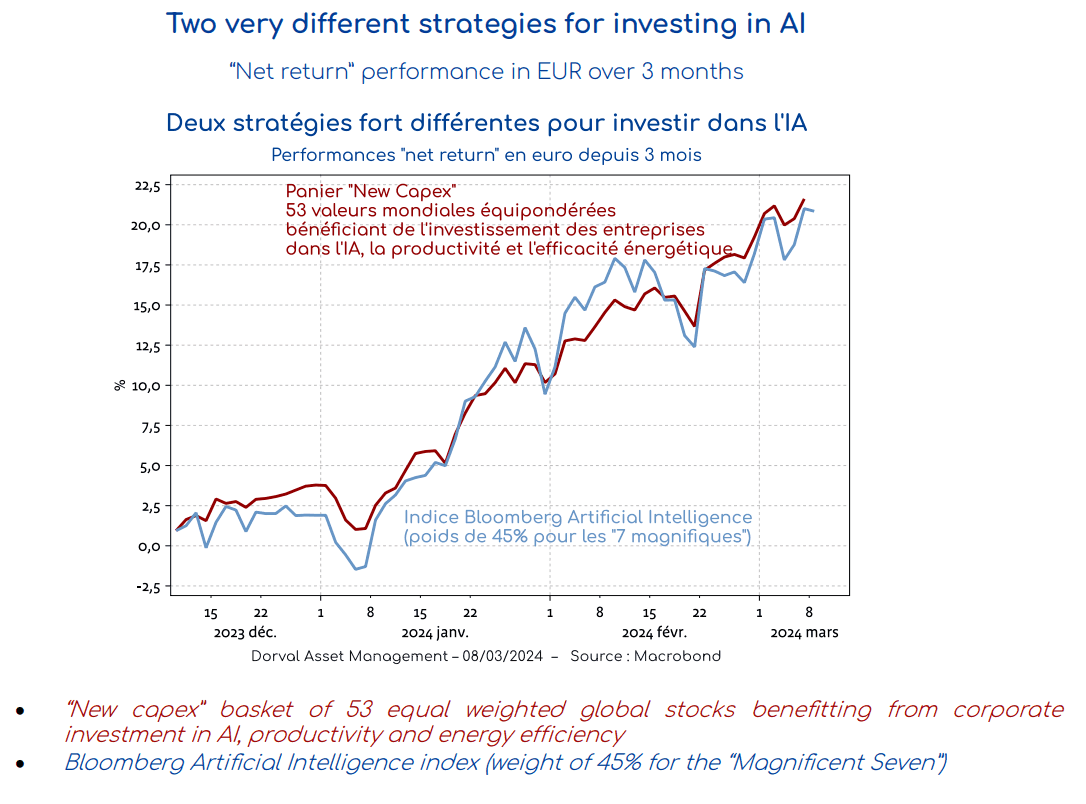

Similarly, equal weighting and systematic diversification also make it possible to better manage specific risks within a theme. For example, 45% of the Bloomberg Artificial Intelligence index – which is composed of 67 stocks weighted by market capitalisations – is dominated by the “Magnificent Seven”, which entails serious risks specific to a few stocks. Our equal weighted approach to the slightly broader theme of new types of corporate investment (“new capex”, including AI) is performing equally well on the stock exchange by taking on board considerably fewer specific risks (cf. chart 3).

Since 2016, we have systematically implemented the equal weighting method for stocks in our international funds within each theme. At present, these themes govern our core basket of 200 stocks, with the new corporate investments (“new capex”) theme applying to 53 stocks, the “global industrial recovery” theme applying to 28 stocks, and the “anti-fragile” theme applying to 24 stocks.