Dorval European Climate Initiative

Investing and supporting the financing of European companies, primarily in the euro area, that offer products and/or services with a positive environmental impact or that contribute to the goals set out in the Paris Agreement

Key points

- A range of stocks that offer products/services with a positive environmental impact.

- Environmental multi-theme active portfolio management approach that makes ‘green intensity’ and decarbonization the building blocks of its management process.

- An Article 9 fund[1], eligible for PEA French share savings plans and carrying the French SRI[2] and Greenfin[3] accreditations, with a sustainable investment objective to keep the temperature warming potential of its investments below the 2°C threshold as compared to the pre-industrial era out to 2100, aligning with the Paris Agreement.

- The fund is exposed to a risk of capital loss.

Evolution of performance

Past performance is not a reliable indicator of future performance. Performance calculation takes into account net dividend re-invested for the fund and net dividend re-invested for the reference indicator. As of 12/31/2021, the reference indicator used for calculating performance fees is the EURO STOXX Total Market Paris-Aligned Benchmark Net Return EUR following the change in strategy for our fund to ensure its eligibility as a sustainable investment fund, investing in economic activities that pursue an environmental or social objective. The reference indicator is denominated in euros.

Performance scenarios

| Recommended investment period: years Example of investment : Scenarios Select... | If you get out after 1 year | If you get out after years | |

|---|---|---|---|

| Minimum | There is no guaranteed minimum return. You could lose all or part of your investment. | ||

| Tensions | What you could get after deducting costs Average annual yields | ||

| Unfavorable | What you could get after deducting costs Average annual yields | ||

| Intermediate | What you could get after deducting costs Average annual yields | ||

| Favorable | What you could get after deducting costs Average annual yields | ||

The essential

- UNIVERS D'INVESTISSEMENTChiefly comprises European stocks primarily in the euro area and covering all market capitalizations

- INDICATEUR DE REFERENCEEURO STOXX Total Market Paris-Aligned Net Return EUR

- DUREE MINIMALE DE PLACEMENT RECOMMANDEE5 Years

Performances

Performances net of management fees

Learn more

Directing investment to support the energy and ecological transition

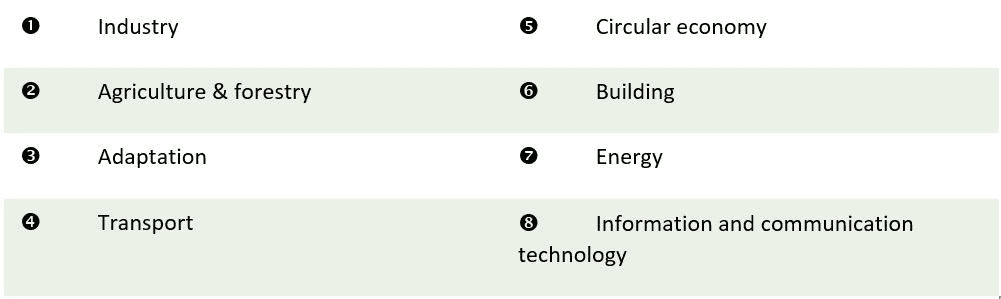

The energy transition requires us to entirely rethink our production processes, our consumption habits and our energy mix. However, this extensive economic transition also offers a range of investment opportunities. Our fund makes ‘green intensity’ and decarbonization the cornerstones of its investment management process and draws on a theme-based approach with an environmental focus, based on 8 “eco-activities” that play an active part in driving the environmental transition and the fight against climate change.

Supporting leading European corporations that harbor robust growth potential

Dorval European Climate Initiative invests in European companies, primarily in the euro area, that offer products and/or services with a positive environmental impact or that contribute to the goals set out in the Paris Agreement. Our “Europe/Euro Area” focus is a result of the zone’s broad investment universe comprising companies that are committed to these themes and enjoy a buoyant regulatory environment for this type of investment.

Offering an environmental multi-theme active portfolio management approach, governed by our stringent socially responsible investment policy

Dorval European Climate Initiative is classified Article 9 under EU SFDR[1] and carries the French SRI accreditation[2] and the Greenfin certification[3]. The fund’s main objective is sustainable investment and seeks to step up companies’ environmental and climate transition. It particularly targets nine of the 17 United Nations Sustainable Development Goals (SDG).

With this in mind, the fund aims to:

- Address the climate emergency alongside investors committed to tackling environmental challenges,

- Invest in European companies, primarily in the euro area, that offer products and/or services with a positive environmental impact based on the Greenfin classification[3],

- Generate financial and non-financial performances as compared with its reference indicator, which aligns with the Paris Agreement,

- Contribute to funding the Fondation EPIC, which fights childhood and youth inequality via stringently selected high-impact social organizations, by donating 10% of the fund’s management fees net of retrocessions.

Our environmental strategy is built on three fundamental components:

Information concerning the methodology and data relating to extra-financial analysis are available in the SRI policy and the Code of transparency of Dorval Asset Management available here.

_

[1] Sustainable Finance Disclosure Regulation (SFDR) seeks to foster greater transparency on environmental and social responsibility on the financial markets. Article 9 funds have a sustainable investment objective.

[2] This accreditation was developed by the French Ministry for the Economy and Finance and is designed to increase the visibility of socially responsible investment (SRI) funds with savers. The certification body conducts an audit to ensure that funds applying for the SRI accreditation comply with the range of label criteria. For more information on the methodology used, visit https://www.lelabelisr.fr/en/. Any references to a ranking, accreditation, award and/or rating are not an indicator of the fund’s or asset manager’s future results.

[3] This public accreditation was developed by the French Ministry for the Ecological Transition, and ensures the green dimension of investment funds. It is designed for financial stakeholders striving to support the common good via transparent and sustainable practices. Achieving the Greenfin label means that part of savings can be mobilized to support the energy and ecological transition. For more information on the methodology used, visit https://www.ecologie.gouv.fr/label-greenfin (website in French). Any references to a ranking, accreditation, award and/or rating are not an indicator of the fund’s or asset manager’s future results.

One last question ?

- The conclusions from scientists, such as the IPCC, are crystal clear. Climate warming is primarily a result of the effects of human activity on the climate and the environment, leading to vast transformation in our planet’s ecosystems, and these impacts are set to step up over time. Today’s business model built on economic growth and the ensuing CO2 emissions affects biodiversity and increases pressure on natural resources, while the world’s population has reached unprecedented numbers. The energy transition requires is to entirely rethink our production processes, our consumption habits and our energy mix. As an investor, we have a crucial responsibility to accelerate this transition by focusing on companies that offer real solutions to drive the economic, ecological and environmental transition.

- We are convinced that this transition requires an extensive transformation across several business sectors, and we have developed our investment process to actively support companies as they take concrete action. Our methodology makes non-financial analysis the cornerstone of our investment process, with 70% of the issuer’s final score now ascertained via ESG criteria i.e. ESG score, ‘green intensity’, belonging to business sectors that promote the transition. We also felt that it was vital to combine our methodology with a clear and informed view that we seek to apply on all aspects related to this transition i.e. there will be winners and losers and it is essential to make every effort to identify them.

Warnings

The information provided is neither contractual in nature nor serves as investment advice.

Past performance is no indicator of future performance. Capital invested is not guaranteed. It is advisable to follow the minimum recommended investment horizon. The characteristics, risks and charges concerning this investment are detailed in the fund prospectus, which is available free of charge from the asset management company.

The tax treatment depends on each client's situation and is subject to change at a later date. Each mutual fund may not be suitable for all investors. The risks of investing in a mutual fund are described in the Prospectus for this mutual fund, which can be downloaded from this site. Dorval Asset Management invites the individuals concerned to familiarise themselves with it.

Dorval Asset Management may not be held liable for any decision taken or not taken based on information contained in this document, or for how it may be used by a third party.

The investor must be given the Key Investor Information Document before subscribing.

Pursuant to provisions in Council Regulation (EU) No 833/2014, the purchase of units/shares in Dorval Asset Management’s funds is prohibited for all Russian and Belarusian nationals, as well as any individuals who are resident in Russia or Belarus and any legal person, entity or body established in Russia or Belarus, apart from nationals of a Member State and individuals holding a temporary or permanent residence permit in a Member State.