Exposure rates of the Dorval Asset Management Range - January 30, 2023

The market capitalization-weighted index remains the standard in the investment management industry. However, the high concentration of these indexes around a few leading stocks represents a significant risk, especially when these stocks lose structural market leadership. This risk can be minimized by using the team-weighting method, which is particularly well suited to investors and savers who aim to achieve true international diversification of their portfolios.

Most managers compare themselves to an index that is almost always weighted by available market capitalizations (the "free float"), such as the CAC 40, the Euro Stoxx 50 or the MSCI World. This approach is justified by the fact that each management is supposed to compare itself to the portfolio held in its universe of stocks. However, the approach has some drawbacks.

Indeed, managers are often led to weight their portfolios not only according to the attractiveness they attribute to each company, but primarily according to their free float capitalization. And if the benchmark index is highly concentrated on a small number of leading stocks (GAFAM in the United States, luxury goods champions in France), the specific risks become significant.

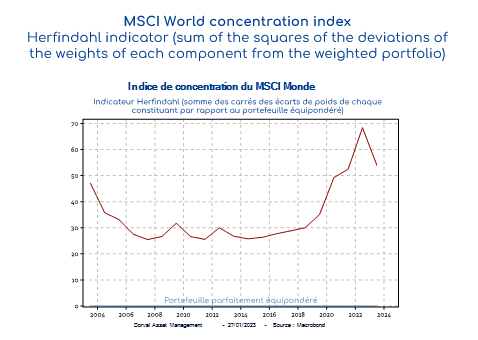

This disadvantage has become a major one, as the MSCI World Index has become increasingly concentrated since the mid-2010s (Figure 1). Today, the top 10 MSCI World stocks account for 18.6% of the index, up from 9.4% in 2014. In a perfectly weighted portfolio, the top 10 stocks would represent only 0.66% of the index (10 divided by 1508 stocks).

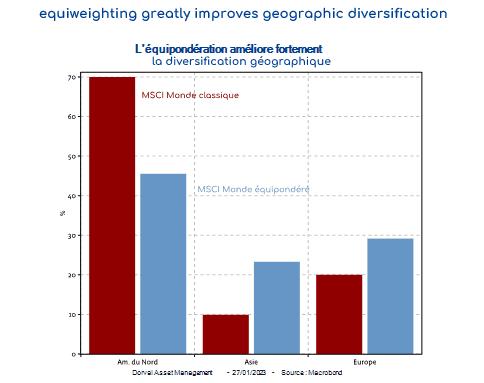

Investors often use international management to diversify their portfolios, so the high concentration of the MSCI World therefore poses serious problems. For example, the end of GAFAM's leadership, could be costly. Conversely, the reference to an equally weighted index allows for the greatest possible diversification by sector (minimization of specific risk). It also considerably improves the level of diversification by region (Figure 2), by country and by sector. While two-thirds of the MSCI World Index is made up of US stocks, the same equally-weighted index reduces the weight of the United States to 40%, to the benefit of Asia (23%, thanks mainly to Japan but also Australia, Hong Kong and Singapore) and Europe (29%). In terms of sectors, the gain in diversification is also very noticeable, with the gap between the smallest and largest sectors narrowing significantly with equiweighting.

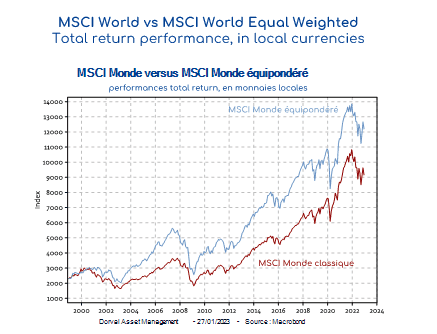

However, the equal weighting method also has another merit. The regular rebalancing of portfolios, which is necessary to ensure that equiweighting is maintained, means taking profits on the stocks that have risen the most, and buying back those that have fallen the most at a lower cost. Over a long period, it has been shown that this "opposite" strategy improves performance (see: "Plyakha Y Uppal R Vilkov G " Why Does an Equal Weighted Portfolio Outperform Value and Price Weighted Portfolios ", EDHEC, March 2012 "). This is one of the reasons why the MSCI World Equal Weighted has, year in and year out, outperformed the MSCI World Traditional over the last twenty years. It should be noted, however, that there are costs involved in managing and rebalancing portfolios with a large number of stocks, even though these costs have fallen considerably over the last two decades. However, these costs can be minimized by the so-called "stratified sampling" method, which makes it possible to replicate the behavior of the index with a much smaller basket than the 1500 stocks of the MSCI World.

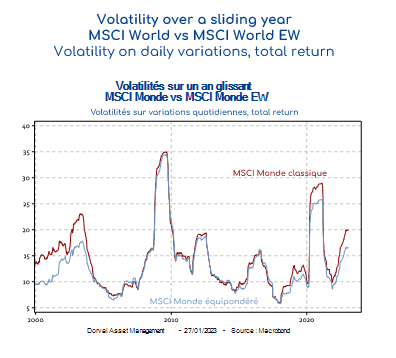

This is the management process followed by Dorval AM's range of global funds (Global Conviction and Global Conviction Patrimoine). Thanks to a core basket of 200 equally-weighted stocks spread across all regions and sectors, we ensure a very high level of diversification, and therefore a strong reduction in specific risks. With the current questioning of the leadership of the GAFAMs, the method allows for a more measured, less concentrated and less expensive (lower P/E) exposure to the US market. For the past three years, particularly in the last few months, equiweighting has also allowed for lower volatility than the traditional MSCI World (chart 4). This advantage in terms of volatility is somewhat similar to what happened in the early 2000s, when the leadership of the TMTs faded. That period was characterized by better performance and lower volatility of the international equi-weighted portfolios compared to the traditional MSCI World. We see much the same thing today.

Current positioning: in our global flexible funds we maintain a fairly high exposure to the equity market. We favor the themes of energy transition (basket of 40 equally weighted stocks), European risk reduction (small stocks) and emerging markets. We have a long position in 10-year US bonds in order to hedge some of the risks of equity volatility that a possible US recession in the first half of the year would generate. We continue to earn a growing monetary return by actively managing the cash portion of our portfolios.