Dorval Convictions

An SRI-labelled offering investing in French and European companies

Key points

- Flexible management from 0 to 100% that adapts to market configurations

- Active and agile management, framed by a rigorous socially responsible investment policy

- Seek to capture the growth of French and European companies

- This product promotes environmental or social characteristics but does not have as its objective a sustainable investment. It might invest partially in assets that have a sustainable objective, for instance qualified as sustainable according to the EU classification

- The fund is exposed to capital loss risk

Evolution of performance

Past performances are no guarantee of future performances. The performance calculations are net earned dividends reinvested for the UCITS. The performance calculations for the benchmark indicator are reinvested net earned dividends.

Performance scenarios

| Recommended investment period: years Example of investment : Scenarios Select... | If you get out after 1 year | If you get out after years | |

|---|---|---|---|

| Minimum | There is no guaranteed minimum return. You could lose all or part of your investment. | ||

| Tensions | What you could get after deducting costs Average annual yields | ||

| Unfavorable | What you could get after deducting costs Average annual yields | ||

| Intermediate | What you could get after deducting costs Average annual yields | ||

| Favorable | What you could get after deducting costs Average annual yields | ||

The essential

- INVESTMENT UNIVERSEMainly European equities and fixed-income products

- REFERENCE INDICATOR50% €STER Capitalised and 50% Euro Stoxx 50 NR (EUR) calculated with net total return since 1 January 2013

- MINIMUM RECOMMENDED INVESTMENT HORIZON3 years

Performances

Performances net of management fees

Learn more

The fund seeks to benefit from the dynamics of the French and European equity markets while seeking to limit the capital loss during reversal periods. To do this, the management team varies the exposure to equities from 0% to 100% according to its expectations. In addition, the fundamental analysis of eligible companies is combined with an approach of environmental, social and governance (ESG) opportunities and risks.

Flexible management from 0 to 100% that adapts to market configurations

Economies are exposed to crises on a recurring basis that can lead to both risks and opportunities. The rate of exposure of the Dorval Convictions portfolio to the equity asset class is determined according to the macroeconomic and microeconomic scenario chosen by the managers. The fund management team may vary the fund’s equity exposure from 0% to 100%; the bond or monetary market exposure may vary from 0% to 100%.

Active and agile management, framed by a rigorous socially responsible investment policy

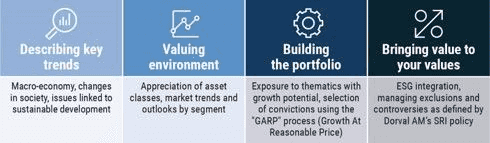

Portfolio construction and management combine financial and extra-financial approaches and are based on:

- A determination of the exposure rate to French and European equities.

- Identification of investment themes considered to have higher potential, i.e. in line with the major trends and the economic and financial context.

- A selection of securities within these investment themes supplemented by securities selected for their own interest and meeting the criteria defined by Dorval AM.

- A distribution of these securities in the portfolio, based on a proprietary rating methodology established from these same criteria and combining financial and extra-financial analyses as well as an analysis of the “executives/companies” tandem.

Information concerning the methodology and data relating to extra-financial analysis are available in the SRI policy and the Code of transparency of Dorval Asset Management available here.

Seek to capture the growth of French and European companies

Among French and European securities, Dorval Convictions invests in large companies, to ensure liquidity and visibility, as well as in SMEs, for their performance accelerating effect.

One last question ?

- "Modern economies are repeatedly exposed to major ups and downs, which can be a source of risk but also opportunity. A flexible management approach means that the split between equities and fixed income products can be adjusted according to market developments. The key benefit of a flexible management approach is that when the economic climate is favourable, it can help investors to exploit the equity market's growth potential while limiting the risk linked to this market. Flexibility is particularly effective because there is significant room for manoeuvre and the fund managers adjust their allocation dynamically, at just the right time. We feel that a flexible management approach is a good solution for riding through market cycles, as it lets the fund managers choose how and when to make adjustments according to their predictions."

- "Once the equity exposure level has been set, we take a discretionary approach to stock-picking. In the stock-picking phase, we focus our research on promising investment themes and consider all market capitalisations. We also place a great deal of importance on the valuation of shares and prefer shares that we feel are undervalued and have growth potential. We then proceed with the investments after ensuring the portfolio has good sector diversification. "

Warnings

The information provided is neither contractual in nature nor serves as investment advice.

Past performance is no indicator of future performance. Capital invested is not guaranteed. It is advisable to follow the minimum recommended investment horizon. The characteristics, risks and charges concerning this investment are detailed in the fund prospectus, which is available free of charge from the asset management company.

The tax treatment depends on each client's situation and is subject to change at a later date. Each mutual fund may not be suitable for all investors. The risks of investing in a mutual fund are described in the Prospectus for this mutual fund, which can be downloaded from this site. Dorval Asset Management invites the individuals concerned to familiarise themselves with it.

Dorval Asset Management may not be held liable for any decision taken or not taken based on information contained in this document, or for how it may be used by a third party.

The investor must be given the Key Investor Information Document before subscribing.

Pursuant to provisions in Council Regulation (EU) No 833/2014, the purchase of units/shares in Dorval Asset Management’s funds is prohibited for all Russian and Belarusian nationals, as well as any individuals who are resident in Russia or Belarus and any legal person, entity or body established in Russia or Belarus, apart from nationals of a Member State and individuals holding a temporary or permanent residence permit in a Member State.