Investment in the energy transition: An international approach - 6 march 2023

Billions are injected into energy transition plans, which continue to crop up across the globe, with each continent and country responding to one another and trying to create the most domestic added value possible in this strategic area. On the stock market, this major theme can lead investors quite naturally to choosing a diversified international approach, provided that this method is chosen well.

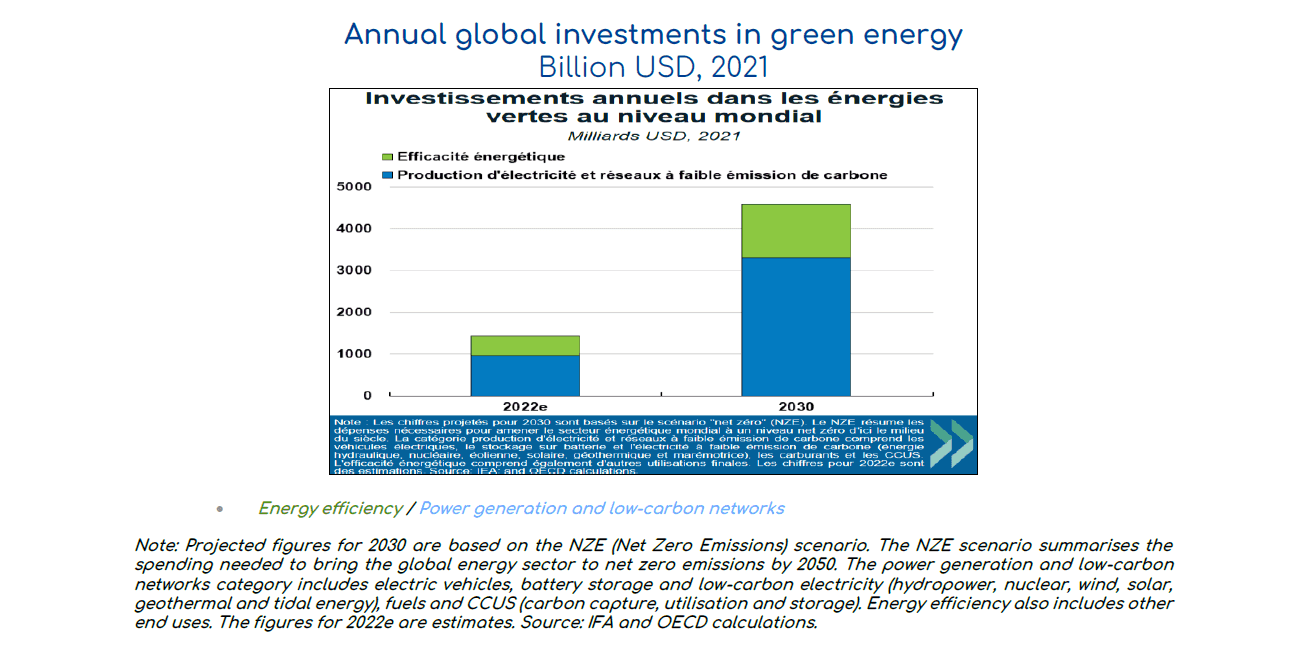

After BRICS in the 2000s and digitalisation in the 2010s, the energy transition is emerging as the major theme of the 2020s. In addition to climate considerations, there are key strategic motives behind this, as we can see with the war in Ukraine. The OECD estimates that global annual investment in green energy could increase from $1400 billion in 2022 to $4600 billion in 2030 (cf. chart 1). This would represent 3% of global GDP (compared to 1.3% in 2022) and more than 10% of global investment (compared to 4.8% today).

A large number of countries and companies are now competing on this theme. The United States, Europe, Japan and China are vying to create projects that attract capital, patents and expertise. This battle covers many sectors of activity, including raw materials, transport, power generation, technology etc. On the stock market, in a universe of international securities from developed markets whose capitalisation exceeds $2 billion, we estimate that more than 300 companies will line up at the starting blocks.

Faced with this major theme, investors have two main complementary options. The first option is to follow each of these securities, or a part of them, and to choose the ones that seem the most promising. This method, called stock-picking is the option preferred by the managers of the Dorval European Climate Initiative Fund, for example.

The second approach aims to engage with the theme in the most diverse and global way possible, without analysing the specific performance of each company, country or region. This apparently simpler method, which is that chosen by the managers of the international funds of Dorval AM (Global Convictions range) also has its requirements. Staying true to our investment process, we give the same weighting to each security in order to avoid ending up with a basket of shares overwhelmingly dominated by a few big names, such as Tesla, Toyota or Microsoft. This equal weight method gives each company the same opportunity and significantly reduces specific risks. In the interests of liquidity, we also only retain securities that are sufficiently traded on the markets.

Secondly, we ensure that this basket of shares will represent as many countries and sectors as possible, with a view to always seeking maximum diversification of risks. Lastly, we only select companies that have the best ratings in relation to Dorval AM’s priority non-financial criteria, especially when it comes to quality of governance. In total, the ‘green deal’ basket of Dorval AM’s international management has included around 40 securities since its implementation began in April 2020. Today, it is divided between Europe (40%), America (32%) and developed Asian countries (28%). In terms of sectors, industrial goods and services dominate (43%), ahead of commodities (27%), utilities (16%), infotech (7%) and the consumer discretionary sector (7%).

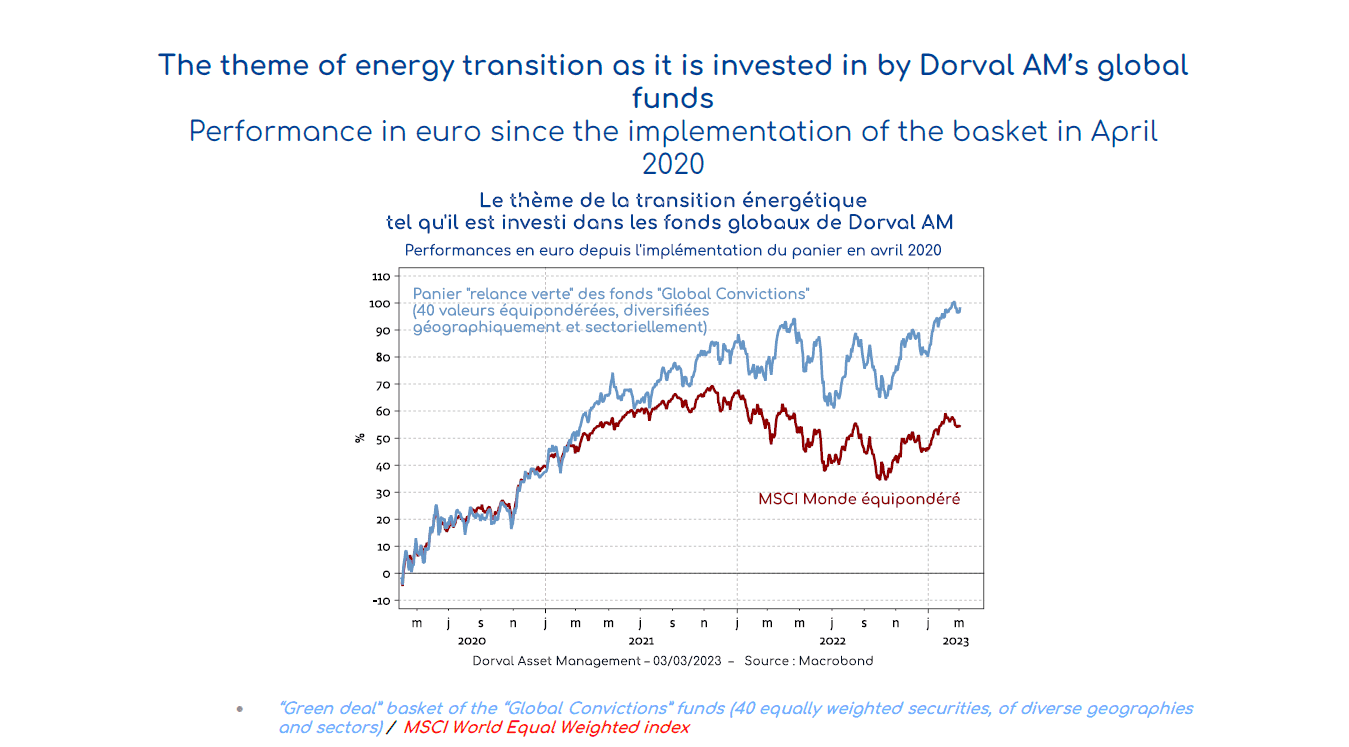

This highly diversified method produces good results. Our ‘green deal’ basket has significantly outperformed our benchmark index, the MSCI World Equal Weighted index (cf. chart 2). It should be noted that the wide diversification of the basket means it can maintain a markedly more reasonable valuation than that of many funds or ETFs that focus on the often very expensive “cleantech” securities. At the end of February, our basket was valued at 15 times the expected profits for 2023, in line with the average of the MSCI World Equal Weighted index.

Finally, the relative weighting of the ‘green deal’ basket in our international funds fluctuates according to our central market trends scenario. The theme of the energy transition is most often driven by cyclical securities and its relevance is quite sensitive to the evolution of commodity prices. We will therefore continue to adapt both the weighting and composition of the basket to the economic and market environment.

We are maintaining a fairly high exposure to the equity market in our global flexible funds, but with option-based hedging. We are focusing on the energy transition (basket of 40 equally weighted securities) and European risk reduction (small securities). Our bond duration is very low, but we are cautiously starting to buy short-term bonds (two to three years to maturity) in Europe, with ECB rate hikes now being better anticipated. We are continuing to earn increasing money returns by actively managing the cash portion of our portfolios.